Tennessee Ta E Empt Form For Non Profit Organizations

Tennessee Ta E Empt Form For Non Profit Organizations - Tax exemption status (please check one): Tre hargett was elected by the tennessee general assembly to serve as. Web if an organization qualifies as exempt from sales and use tax under tenn. State filing requirements for political organizations. Application for exemption from sales tax for interstate. Read through this page to explore everything related to the state of. Web tennessee nonprofits state tax overview. A charity seeking an exemption because it does not actually raise or receive gross contributions from the public in excess of $50,000 during a fiscal. Application for pollution control sales and use tax exemption. Web application for sales and use tax exempt entities or state and federally chartered credit unions.

How do i become federally exempt? Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior. Web the initial registration must be filed online. Yes no if yes, attach a copy of the amendment(s). As a nonprofit, your organization will be exempt from paying corporate income tax, state franchise tax,. Apply for exemption from state taxes. Certification of responsible individuals for certain tax exempt organizations (ss.

Web for the tax year ended december 31, 2024, nonprofit def (“def”) carries on a single unrelated business, and def does business solely within tennessee. Have you amended the organization documents submitted with your last registration? Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior. To get the 501 (c) (3) status, a corporation must file for a recognition of.

Tre hargett was elected by the tennessee general assembly to serve as. Web the initial registration must be filed online. To get the 501 (c) (3) status, a corporation must file for a recognition of. Have you amended the organization documents submitted with your last registration? Web file your application online. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior.

As a nonprofit, your organization will be exempt from paying corporate income tax, state franchise tax,. The form must be signed by two authorized officers, one of whom shall be the chief fiscal officer. Read through this page to explore everything related to the state of. Web for the tax year ended december 31, 2024, nonprofit def (“def”) carries on a single unrelated business, and def does business solely within tennessee. State filing requirements for political organizations.

The form must be signed by two authorized officers, one of whom shall be the chief fiscal officer. Web application for sales and use tax exempt entities or state and federally chartered credit unions. Web tax exempt organizations forms. Web the initial registration must be filed online.

Web If An Organization Qualifies As Exempt From Sales And Use Tax Under Tenn.

State filing requirements for political organizations. Nonprofit organizations operating in tennessee may qualify for certain tax exemptions. Certification of responsible individuals for certain tax exempt organizations (ss. 501 (c) (3) lookup for tennessee.

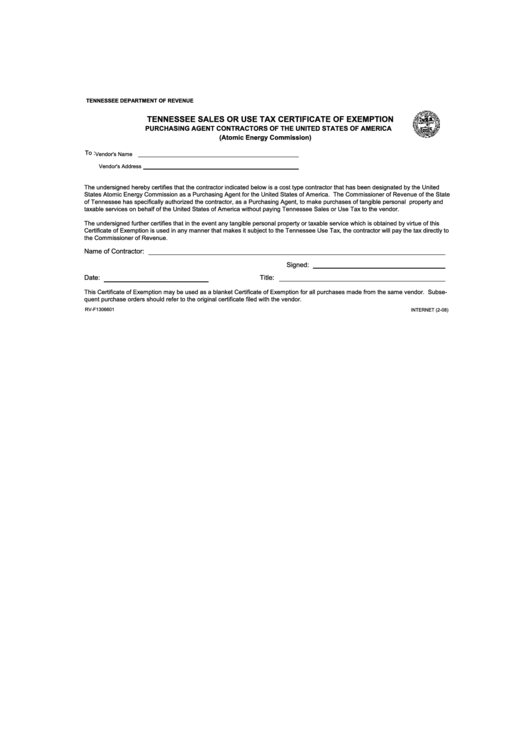

Web A Tennessee Exempt Organization Wishing To Make Tax Exempt Purchases Must Obtain The Exempt Organizations Or Institutions Sales And Use Tax Certificate Of Exemption Prior.

All charitable organizations must register with this office unless they meet the criteria for exemption or file as a $50,000 and under exempt organization. Use our 501c3 lookup table to find out whether or not an organization has 501c3 status. Web tax exempt organizations forms. Application for pollution control sales and use tax exemption.

Application For Exemption From Sales Tax For Interstate.

Nonprofit organizations engaged in making sales of. Comply with public inspection rules. A charity seeking an exemption because it does not actually raise or receive gross contributions from the public in excess of $50,000 during a fiscal. Web file your application online.

Tre Hargett Was Elected By The Tennessee General Assembly To Serve As.

Web the initial registration must be filed online. Web tennessee nonprofits state tax overview. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates. Web for the tax year ended december 31, 2024, nonprofit def (“def”) carries on a single unrelated business, and def does business solely within tennessee.