Te As Agricultural Ta E Empt Form

Te As Agricultural Ta E Empt Form - Web this agricultural exemption, often referred to as the ag exemption, provides a means for landowners using their property for bona fide agricultural. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Before the first day of. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. They include graphics, fillable form fields, scripts and functionality that work best with. Web find everything you need to know about agricultural tax exemptions in texas. Renew your ag timber number now! This comprehensive guide provides details on eligibility requirements, application. Web an agricultural exemption in grayson county is a form of property tax relief for landowners who engage in bona fide agricultural use of their land. The forms listed below are pdf files.

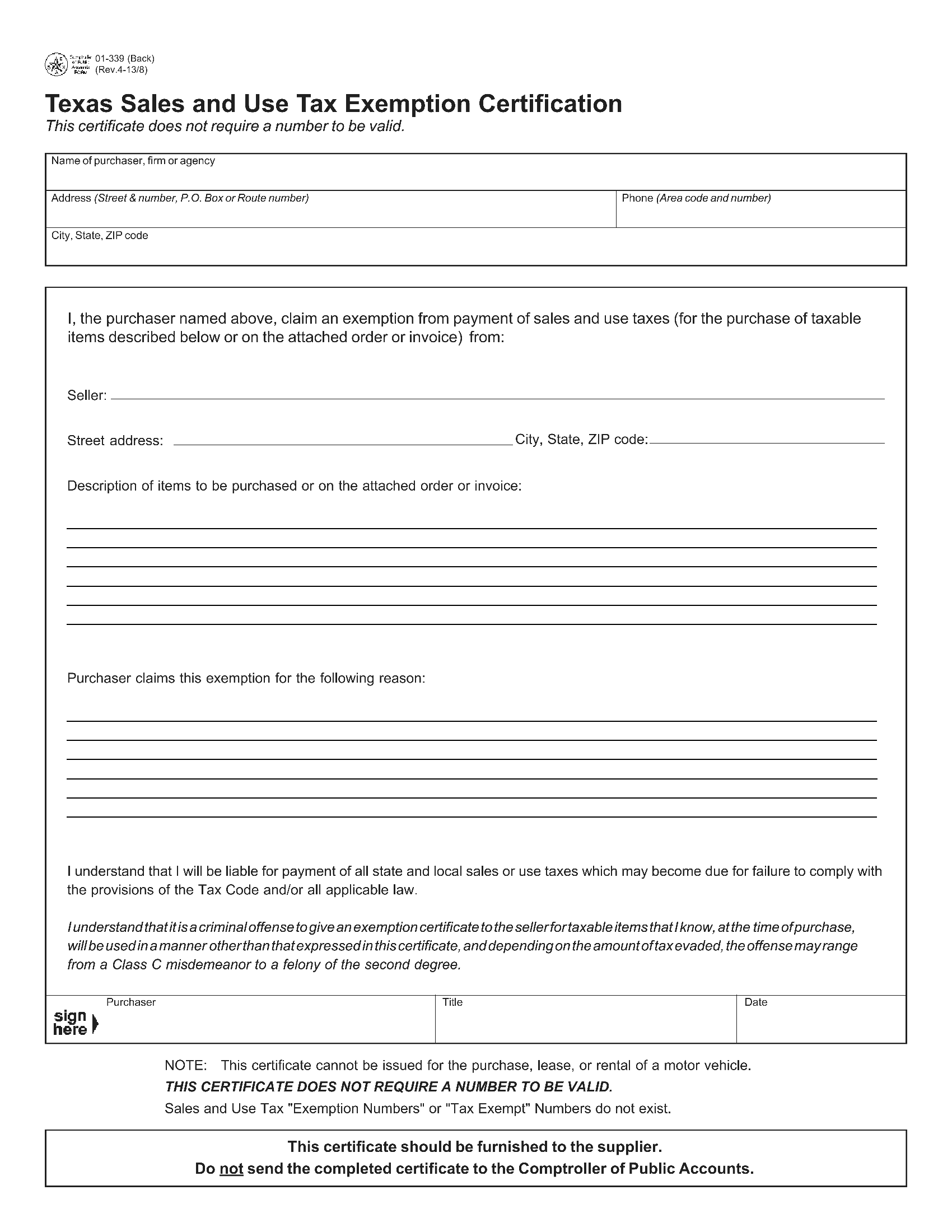

Commercial agricultural producers must use this form to claim exemption from texas. Registration number (must enter 11 numbers) or. They include graphics, fillable form fields, scripts and functionality that work best with. Renew your ag timber number now! This blog covers all 254 counties and provides information on. Web an agricultural exemption in grayson county is a form of property tax relief for landowners who engage in bona fide agricultural use of their land. To qualify for an agricultural exemption in hunt county, applicants must provide several important pieces of documentation.

Your mailing address and contact information; 1, 2012, a person claiming an exemption from sales tax on the purchase of certain items used in the production of agricultural and timber products is required to. They include graphics, fillable form fields, scripts and functionality that work best with. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when. This comprehensive guide provides details on eligibility requirements, application.

Posted on december 13, 2023 by tiffany.dowell. Web texas agricultural and timber exemption forms. Web find agricultural exemption eligibility requirements and application instructions specific to each county in texas. They include graphics, fillable form fields, scripts and functionality that work best with. Renew your ag timber number now! Registration number (must enter 11 numbers) or.

1, 2012, a person claiming an exemption from sales tax on the purchase of certain items used in the production of agricultural and timber products is required to. The forms listed below are pdf files. Middle name (optional) last name. They include graphics, fillable form fields, scripts and functionality that work best with. Texas producers who have a valid agricultural.

This blog covers all 254 counties and provides information on. Producers of agricultural products for sale must provide this completed form to retailers when claiming an. To qualify for an agricultural exemption in hunt county, applicants must provide several important pieces of documentation. Middle name (optional) last name.

Before The First Day Of.

Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web texas agricultural sales and use tax exemption certificate. Renew your ag timber number now! To qualify for an agricultural exemption in hunt county, applicants must provide several important pieces of documentation.

Texas Producers Who Have A Valid Agricultural.

This comprehensive guide provides details on eligibility requirements, application. They include graphics, fillable form fields, scripts and functionality that work best with. 1, 2012, a person claiming an exemption from sales tax on the purchase of certain items used in the production of agricultural and timber products is required to. Web find everything you need to know about agricultural tax exemptions in texas.

This Blog Covers All 254 Counties And Provides Information On.

Your mailing address and contact information; Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when. Posted on december 13, 2023 by tiffany.dowell. The forms listed below are pdf files.

Web Find Agricultural Exemption Eligibility Requirements And Application Instructions Specific To Each County In Texas.

Web this agricultural exemption, often referred to as the ag exemption, provides a means for landowners using their property for bona fide agricultural. Web an agricultural exemption in grayson county is a form of property tax relief for landowners who engage in bona fide agricultural use of their land. Web texas agricultural sales and use tax exemption certification. Producers of agricultural products for sale must provide this completed form to retailers when claiming an.