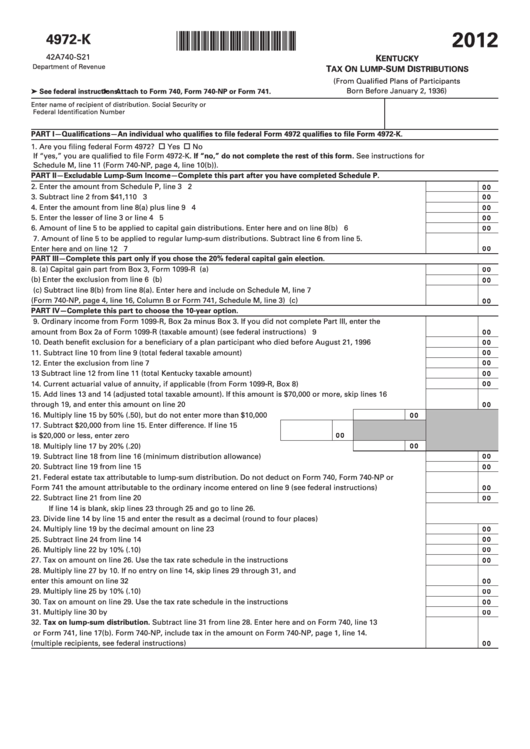

Ta From Form 4972

Ta From Form 4972 - About form 8915, qualified disaster retirement plan distributions and repayments. Download or request forms to help you send your tax return either. Note that any link in the information above. How to calculate the tax. Use distribution code a and answer all questions. It is required to be completed. However, congress increased the penalty for the 2018 and later tax. Free downloads of customizable forms. Web this article will walk you through how to use irs form 4972 to: Screen in the income folder to complete form 4972.

Web prior to the 2018 tax year, the failure to file form 5472 could result in a civil penalty of $10,000. Use this form to figure the. Note that any link in the information above. It is required to be completed. About form 8915, qualified disaster retirement plan distributions and repayments. Report the capital gain portion of the distribution on form. However, congress increased the penalty for the 2018 and later tax.

The form is used to take advantage of special grandfathered taxation options. Note that any link in the information above. If your answers are accurate,. Web 1 best answer. Download or request forms to help you send your tax return either.

(from qualified plans of participants born before january 2, 1936) attach. Web prior to the 2018 tax year, the failure to file form 5472 could result in a civil penalty of $10,000. (from qualified plans of participants born before. Self assessment tax return forms. It is required to be completed. Use distribution code a and answer all questions.

(from qualified plans of participants born before. Download or request forms to help you send your tax return either. (from qualified plans of participants born before january 2, 1936) attach. (from qualified plans of participants born before. About form 8915, qualified disaster retirement plan distributions and repayments.

If your answers are accurate,. Download or request forms to help you send your tax return either. Note that any link in the information above. The form is used to take advantage of special grandfathered taxation options.

Note That Any Link In The Information Above.

Use this form to figure the. Self assessment tax return forms. It is required to be completed. (from qualified plans of participants born before.

Download Or Request Forms To Help You Send Your Tax Return Either.

If your answers are accurate,. The marginal tax rate ranges. Web 1 best answer. The form is used to take advantage of special grandfathered taxation options.

Use Distribution Code A And Answer All Questions.

Free downloads of customizable forms. About form 8915, qualified disaster retirement plan distributions and repayments. (from qualified plans of participants born before. What is the form used for?

How To Calculate The Tax.

Screen in the income folder to complete form 4972. (from qualified plans of participants born before january 2, 1936) attach. Report the capital gain portion of the distribution on form. Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll over the.