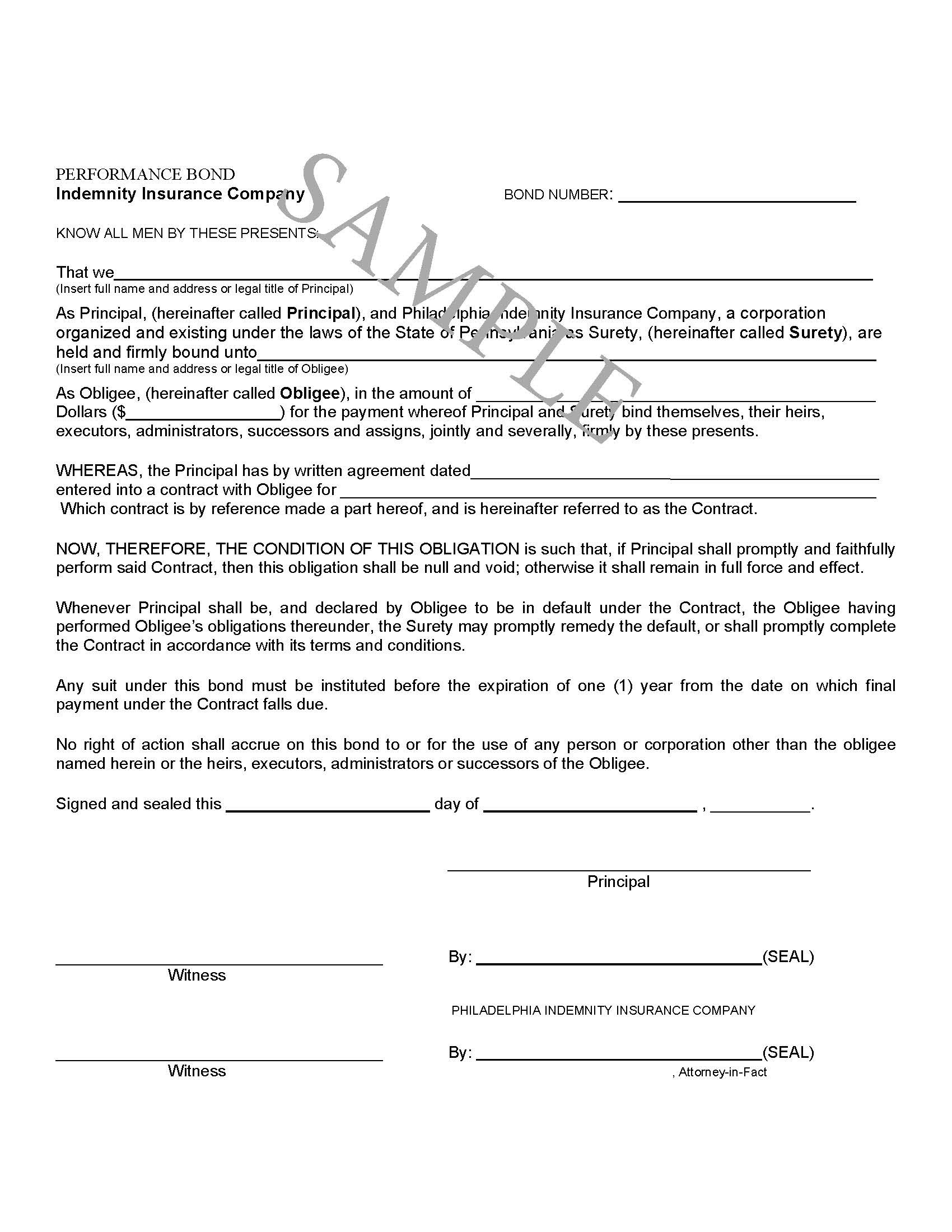

Surety Bond Sample

Surety Bond Sample - Web you can see a sample of surety bond reference letter to the right or by clicking here. Web by using examples, a construction project owner’s guide to surety bond claims will help you understand the process, the participants, and the complexities that are a part of every bond claim and why things happen during the course of a surety claim. A surety bond is a financial instrument that protects against financial loss stemming from an adverse event that disrupts or prevents. Web according to those working within the surety (bond) market, a performance bond is a tripartite agreement whereby a surety (the guarantor) guarantees the contractual obligations of a principal (the contactor) to the beneficiary (the employer) in the event that the principal breaches the contract or becomes insolvent. Web a sample surety agreement is one that shows the basic terms of the performance or payment bond. By reviewing the bond form, you’ll understand your responsibilities you are agreeing to uphold and the consequences you’ll face should you receive a valid claim against your bond. They function like any surety bond, but also require an indemnity agreement between the surety and the bondholder. Web a surety bond is a contract between three parties—the principal (one executing the bond), the surety (guarantor) and the obligee (the entity requiring the bond)—in which the surety financially guarantees to an obligee that the principal will act in accordance with the terms established by the bond. Fact checked by fernando flores. Sample bond forms and surety documents, as.

Web a surety bond serves as a contract between you (the principal), the surety and the entity requiring you to purchase the bond (the obligee). The government agency wants a guarantee that work will be. Say a local government agency hires you to build a road. The surety company provides your customer with the bond which must then be signed and submitted either electronically, in person, or via mail to the obligee’s address. Web you can see a sample of surety bond reference letter to the right or by clicking here. Rhaea lehman february 10, 2021. Why is security bond by a surety required?

Rhaea lehman february 10, 2021. Sample bond forms and surety documents, as. Fill out online for free. Web a surety bond is a contract between three parties—the principal (one executing the bond), the surety (guarantor) and the obligee (the entity requiring the bond)—in which the surety financially guarantees to an obligee that the principal will act in accordance with the terms established by the bond. This book presents the complex field of suretyship for construction contracts by describing and analyzing each element of the surety bonding process in basic terms.

A surety bond is a contract between three parties. Say a local government agency hires you to build a road. It is used as an assurance that the issuer will pay any debts if the other party fails to do so. Web a surety bond is a contract among a minimum of three parties where if the principal defaults or fails to perform an obligation, a surety is obligated to fulfill a duty such as paying a certain amount. Web here’s an example of how a surety bond works: On the surface, filing a surety bond seems simple enough.

Fact checked by fernando flores. On the surface, filing a surety bond seems simple enough. Web (a) if a required surety payment is payable pursuant to the surety bond with respect to any pledged asset mortgage loan, the company shall so notify the trustee as soon as reasonably practicable and shall, on behalf of the trustee for the benefit of the certificateholders, promptly complete the notice in the form of attachment 1 to the. Our informative guide on how to read a surety bond can help you ensure your bond meets all the requirements prior to submitting it to your obligee. Web a surety bond is a contract between three parties—the principal (one executing the bond), the surety (guarantor) and the obligee (the entity requiring the bond)—in which the surety financially guarantees to an obligee that the principal will act in accordance with the terms established by the bond.

Web the surety bond form index (sbfi) is a collection of searchable contract surety and commercial surety bond form samples. A surety bond is a financial instrument that protects against financial loss stemming from an adverse event that disrupts or prevents. Why is security bond by a surety required? Web by using examples, a construction project owner’s guide to surety bond claims will help you understand the process, the participants, and the complexities that are a part of every bond claim and why things happen during the course of a surety claim.

What Is A Surety Bond?

Fill out online for free. Web a surety bond is a contract between three parties—the principal (one executing the bond), the surety (guarantor) and the obligee (the entity requiring the bond)—in which the surety financially guarantees to an obligee that the principal will act in accordance with the terms established by the bond. Rhaea lehman february 10, 2021. Web the surety bond form index (sbfi) is a collection of searchable contract surety and commercial surety bond form samples.

Web A Surety Bond Is A Contract Among A Minimum Of Three Parties Where If The Principal Defaults Or Fails To Perform An Obligation, A Surety Is Obligated To Fulfill A Duty Such As Paying A Certain Amount.

Your company is hired for a job. A surety bond is a legally binding contract. Without registration or credit card. The surety company provides your customer with the bond which must then be signed and submitted either electronically, in person, or via mail to the obligee’s address.

Say A Local Government Agency Hires You To Build A Road.

This book presents the complex field of suretyship for construction contracts by describing and analyzing each element of the surety bonding process in basic terms. Fact checked by fernando flores. Web (a) if a required surety payment is payable pursuant to the surety bond with respect to any pledged asset mortgage loan, the company shall so notify the trustee as soon as reasonably practicable and shall, on behalf of the trustee for the benefit of the certificateholders, promptly complete the notice in the form of attachment 1 to the. Surety bonds are an integral component of many business transactions and agreements, serving as a form of financial guarantee that one party will fulfill its obligations to another.

Drafting A Surety Agreement Is An Integral Part Of Doing Business And Is Essential For Protecting The Interests Of All Parties Involved In A Transaction.

Web you can see a sample of surety bond reference letter to the right or by clicking here. Sample bond forms and surety documents, as. It is used as an assurance that the issuer will pay any debts if the other party fails to do so. The surety is the company (or individual) that is providing the guarantee under the agreement.

![How to Obtain a Surety Bond [Infographic]](https://i0.wp.com/www.suretybonds.com/blog/wp-content/uploads/2013/08/How-to-Get-a-Surety-Bond-infographic.jpg?resize=2083%2C3125&ssl=1)