State Of Ohio New Hire Form

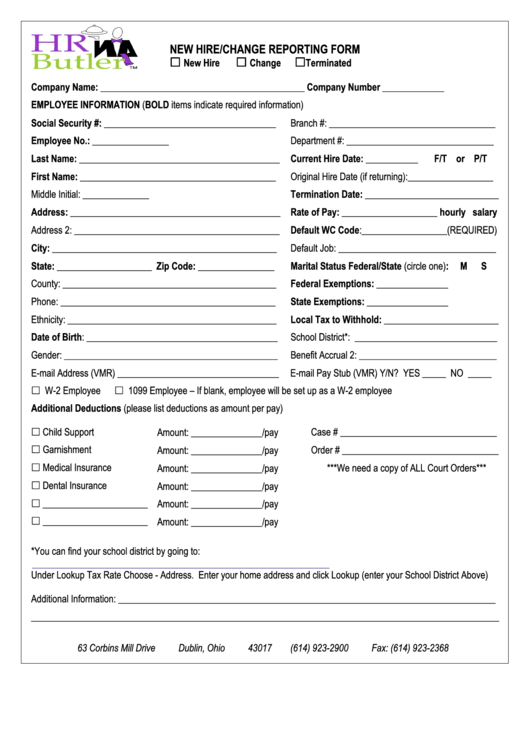

State Of Ohio New Hire Form - View a complete list of injured worker forms to print, download, or order. State and federal laws require employers to report paid individuals regardless of. All employers with business operations in the state of ohio are required to report all independent contractors, newly hired, or rehired employees who live or work in ohio within twenty (20) days of the employees’ first day on the job. Alternatively, you can employ a contractor and prepare this statement to report their date of hire. Your first day | your first week | your first year. Have your employees complete form 7048. Web ohio new hire reporting. One of the most important forms you have to give to a new. All employers are required to report every employee and independent contractor working in ohio to the ohio new hire reporting center within 20 days of the date of hire. Confirm your start date, time, location, etc.

View a complete list of injured worker forms to print, download, or order. Alternatively, you can employ a contractor and prepare this statement to report their date of hire. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax. Federal and state laws require employers to report newly hired employees. Complete your new hire forms electronically through myohio.gov. Web and on jan. Info on how to report new hires and changes in employee status.

Web employers may report new employees using a variety of methods through ohio new hire reporting center, including online reporting, electronic reporting, mail or fax. New hire reporting is essential to helping children receive the support they deserve. Web the state's retirement plan is set up through the ohio public employees retirement system (opers). This law helps improve child support collections and lower public assistance. One of the most important forms you have to give to a new.

As of 12/7/20 this new version of the it 4 combines and replaces the following forms: Web and on jan. Web ohio it 4 is an ohio employee withholding exemption certificate. Web what is new hire reporting? Have your employees complete form 7048. Web employers may report new employees using a variety of methods through ohio new hire reporting center, including online reporting, electronic reporting, mail or fax.

Obtain a federal employer identification number (ein). Web new hire forms in ohio (oh) the following new hire forms include required federal and state forms, as well as additional forms that may be helpful as part of your onboarding process. Federal and state laws require employers to report newly hired employees. Information about new hire reporting and online reporting is available on our website: Ohio revised code section 3121.89 to 3121.8910 requires all ohio employers, both public and private, to report all contractors and newly hired employees to the state of ohio within 20 days of the contract or hire date.

Web form jfs 07048, ohio new hire reporting, is a formal statement used by ohio private and public employers to inform the government about the individual recently hired by their business. All employers are required to report new employees or contractors within 20 days of the date of hire. Web ohio it 4 is an ohio employee withholding exemption certificate. The rule will also increase the total annual compensation requirement for highly compensated employees.

Web Ohio New Hire Reporting.

School district of residence (see the finder at tax.ohio. Your supervisor may also have paper forms. Web ohio new hire reporting. Web employers may report new employees using a variety of methods through ohio new hire reporting center, including online reporting, electronic reporting, mail or fax.

The Employee Uses The Ohio It 4 To Determine The Number Of Exemptions That The Employee Is Entitled To Claim, So That The Employer Can Withhold The Correct Amount Of Ohio Income Tax.

New hire reporting is essential to helping children receive the support they deserve. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. First, register with the ohio secretary of state. Explore resources to help you attract, recruit, hire, train, and retain ohio workers to make your business successful.

Web An Official State Of Ohio Site.

Alternatively, you can employ a contractor and prepare this statement to report their date of hire. Web ohio it 4 is an ohio employee withholding exemption certificate. Complete your new hire forms electronically through myohio.gov. Web and on jan.

Additional Irs Forms And Publications.

All employers are required to report every employee and independent contractor working in ohio to the ohio new hire reporting center within 20 days of the date of hire. All employers are required to report every employee and independent contractor working in ohio to the ohio new hire reporting center within 20 days of the date of hire. Web what is new hire reporting? Your first day | your first week | your first year.