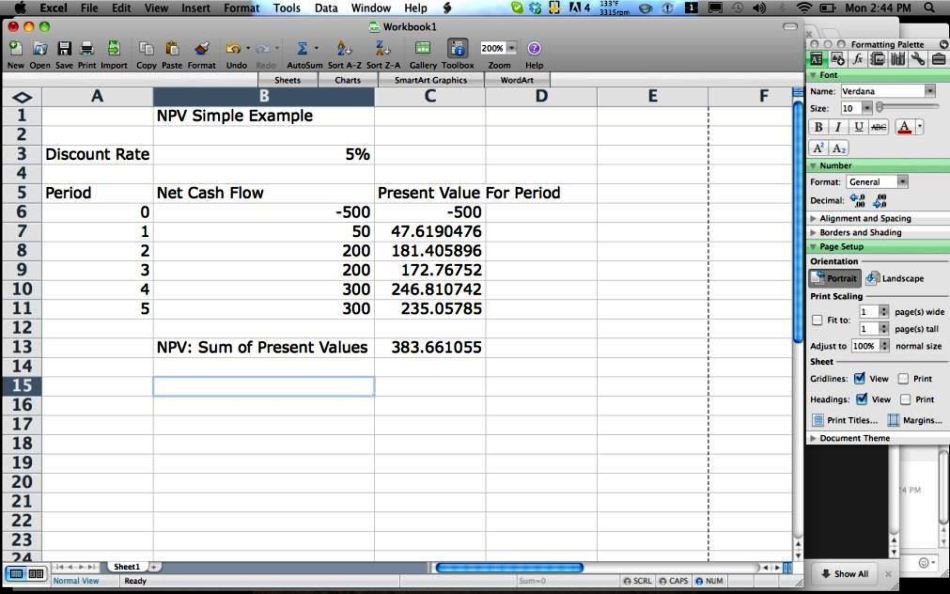

Present Value E Cel Template

Present Value E Cel Template - Web calculating present value in excel can be a powerful tool for making financial decisions and evaluating investments. Nperiods is the number of. It can help you to know whether your investment or a project is profitable or. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Present value (pv) is the current value of a future cash flow, given a specific rate of return. At the same time, you'll learn how to use the pv. Calculate present value of investment. The syntax for present value in excel is. Web the pv function in excel allows you to calculate the present value of a series of future cash flows, considering factors such as the interest rate, the total. Web dcf present value (pv) calculation example.

It can help you to know whether your investment or a project is profitable or. Web updated december 20, 2023. The syntax for present value in excel is. Analysts and investors are able to account for the time value of. Web present value function syntax: Web the pv function in excel allows you to calculate the present value of a series of future cash flows, considering factors such as the interest rate, the total. Syntax of the pv function.

Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. The pv in excel calculates the present value of the investments made by the investor in the form of shares, bonds,. Its value with all equity financing. If we assume a discount rate of 6.5%, the discounted fcfs can be calculated using the “pv” excel function. Present value (pv) is the current value of a future cash flow, given a specific rate of return.

Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. Web updated december 20, 2023. Calculate the value of the unlevered firm or project (vu), i.e. At the same time, you'll learn how to use the pv. Net present value ( npv) is a core component of corporate budgeting. Web calculating present value in excel can be a powerful tool for making financial decisions and evaluating investments.

Calculate the value of the unlevered firm or project (vu), i.e. Calculate present value of investment. =pv ( 4%, 5, 0, 15000 ) for example, the spreadsheet on the right shows the excel pv function used to calculate the present value of an investment that earns an. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. Its value with all equity financing.

It is commonly used to evaluate whether a project or. Equalizing the rate and the. =pv (rate, nperiods, pmt, [fv], [type]) rate is the period interest rate. Calculate the value of the unlevered firm or project (vu), i.e.

Syntax Of The Pv Function.

Web present value function syntax: Present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Calculate the value of the unlevered firm or project (vu), i.e. Single cash flow with compound interest.

Web Basic Pv Formula.

Calculate present value of annuity. Analysts and investors are able to account for the time value of. Web the pv function in excel allows you to calculate the present value of a series of future cash flows, considering factors such as the interest rate, the total. Equalizing the rate and the.

Present Value (Pv) Is The Current Value Of A Future Cash Flow, Given A Specific Rate Of Return.

The pv in excel calculates the present value of the investments made by the investor in the form of shares, bonds,. Web updated may 31, 2021. It is commonly used to evaluate whether a project or. The syntax for present value in excel is.

Calculate Present Value Of Investment.

Its value with all equity financing. Web dcf present value (pv) calculation example. To do this, discount the stream of fcfs by the unlevered cost of capital (ru). Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows.