Pay Date Decimal Calendar

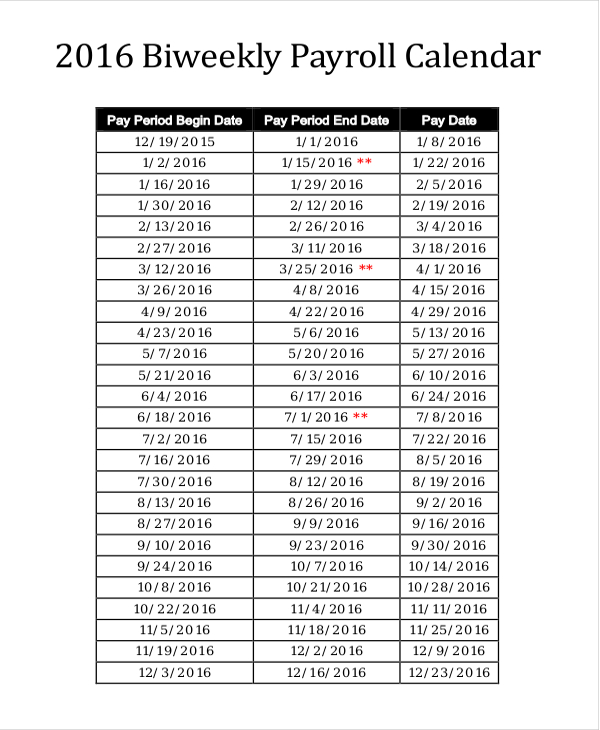

Pay Date Decimal Calendar - Web pay period calendars by calendar year. , current pay amount : When you start work, your employer should tell you how much you’ll be paid and how often. , employment begin date : They should also tell you: The day or date you’ll be paid, for example each. Instead of of counting days in the calendar,. Pay period calendars by fiscal year (one year) pay period calendars by fiscal year (two years) last updated / reviewed: So the first two weeks of january would be pay period one, and the second two weeks of january. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay.

For example, a decimal month would consist of a year with 10 months and. When you start work, your employer should tell you how much you’ll be paid and how often. Hmrc (her majesty’s revenue and customs) use their tax calendar to break payroll dates into tax weeks/months. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. When is this invoice due? Web looking at the chart below, you can see that any pay dates that fall on and between the 6th april and 12th april falls into the 1st pay period of the tax year. Web pay stub decimal calendar.

Enter a start date and add or subtract any number of days, months, or years. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. For example, a decimal month would consist of a year with 10 months and. , employment begin date : Calculate your loan payoff date and find out how long it might take to pay off your.

Hmrc (her majesty’s revenue and customs) use their tax calendar to break payroll dates into tax weeks/months. If the pay period we come up with doesn't match, try a nearby date which matches. Web enter the first pay period end date for the pay calendar. The day or date you’ll be paid, for example each. Web pay period calendars by calendar year. Calculate your loan payoff date and find out how long it might take to pay off your.

Enter a start date and add or subtract any number of days, months, or years. So the first two weeks of january would be pay period one, and the second two weeks of january. If the pay period we come up with doesn't match, try a nearby date which matches. Web pay stub decimal calendar. Hmrc (her majesty’s revenue and customs) use their tax calendar to break payroll dates into tax weeks/months.

Hmrc (her majesty’s revenue and customs) use their tax calendar to break payroll dates into tax weeks/months. Web pay stub decimal calendar. Web monthly payment you are making: This calendar is fixed and does not change year.

Hmrc (Her Majesty’s Revenue And Customs) Use Their Tax Calendar To Break Payroll Dates Into Tax Weeks/Months.

When you start work, your employer should tell you how much you’ll be paid and how often. Web national finance center created date: Go through the calendar for the current year and identify your pay dates and the corresponding pay. Web enter the first pay period end date for the pay calendar.

To Build A Pay Calendar For A Partial Calendar Year,.

If the pay period we come up with doesn't match, try a nearby date which matches. Add to or subtract from a date. 24th of october +100 days? Web result a decimal calendar is a calendar which includes units of time based on the decimal system.

This Calendar Is Fixed And Does Not Change Year.

Enter a start date and add or subtract any number of days, months, or years. For example, a decimal month would consist of a year with 10 months and. A decimal calendar is a calendar. Calculate your loan payoff date and find out how long it might take to pay off your.

Web Monthly Payment You Are Making:

Web pay period calendars by calendar year. Web looking at the chart below, you can see that any pay dates that fall on and between the 6th april and 12th april falls into the 1st pay period of the tax year. Web a decimal calendar is a calendar which includes units of time based on the decimal system. They should also tell you: