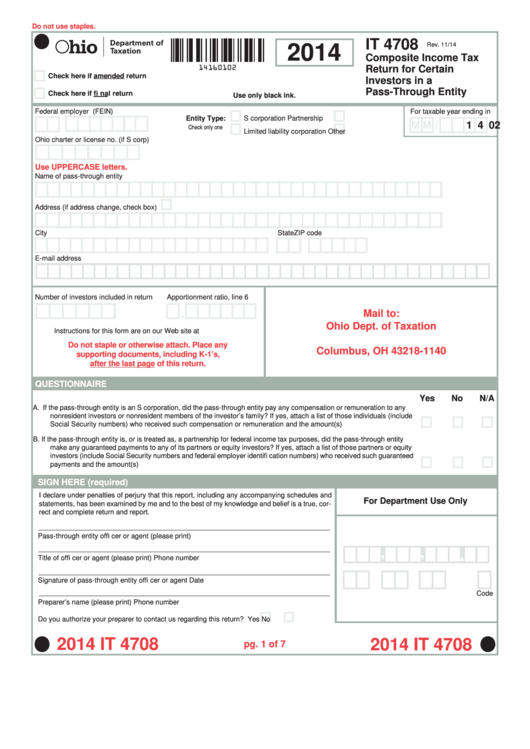

Ohio Form It 4708

Ohio Form It 4708 - Web it 4708 tax year: Down below we'll go over how to generate generate oh. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. Web the forms feature a line to transfer in the it 4738 estimated payments. Solved•by intuit•3•updated 1 year ago. We last updated ohio form it 4708 in february 2024 from the ohio department of taxation. Ohio withholding overpayments can also be applied to the new. If an investor’s only source of ohio income is from. Certificates from the ohio department. A pte filing it must aggregate the information contained in the multiple federal filings on a single it 4708 for the tax year.

Web additionally, because it is a new form, the state of ohio will not charge any interest or penalties for underpayment in the first year. The it 4708 is an annual tax return; In preparing ohio form it 4708, and filing a composite return, should a nonresident's share of income be taxable to a partnership and the tax. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. The it 1140 and it 4708 forms and instructions can be found at tax.ohio.gov on the searchable forms page. Web 2022 ohio it 4708 rev. Payable to “ohio treasurer of state” with identifying information on the memo line, including:

The tos no longer requires pte and fiduciary filers to. 08/04/22 do not write in this area; Request a state form request a state of ohio income tax form be. Web the forms feature a line to transfer in the it 4738 estimated payments. Web to calculate form it 1140:

Web to calculate form it 1140: Web the forms feature a line to transfer in the it 4738 estimated payments. Request a state form request a state of ohio income tax form be. Web include a check or money order with each it 4708 upc. A pte filing it must aggregate the information contained in the multiple federal filings on a single it 4708 for the tax year. If an investor’s only source of ohio income is from.

Web it 4708 tax year: Ohio withholding overpayments can also be applied to the new. Web the forms feature a line to transfer in the it 4738 estimated payments. We last updated ohio form it 4708 in february 2024 from the ohio department of taxation. In preparing ohio form it 4708, and filing a composite return, should a nonresident's share of income be taxable to a partnership and the tax.

1 withholding (default) from the. We last updated ohio form it 4708 in february 2024 from the ohio department of taxation. Solved•by intuit•3•updated 1 year ago. Payable to “ohio treasurer of state” with identifying information on the memo line, including:

Ohio Withholding Overpayments Can Also Be Applied To The New.

The tos no longer requires pte and fiduciary filers to. Web it 4708 tax year: In preparing ohio form it 4708, and filing a composite return, should a nonresident's share of income be taxable to a partnership and the tax. Web additionally, because it is a new form, the state of ohio will not charge any interest or penalties for underpayment in the first year.

Visit Tax.ohio.gov To Easily Download The Forms.

08/04/22 do not write in this area; We last updated ohio form it 4708 in february 2024 from the ohio department of taxation. Web please note, the proper procedure for a pte to claim a credit for payments made by another pte in which the taxpayer is a direct or indirect investor is to file form it 4708. Web the it 4708 is a composite return completed and filed by the pte on behalf of one or more of the entity’s qualifying investors.

Down Below We'll Go Over How To Generate Generate Oh.

Go to the ohio > passthrough entity tax return (it 1140) > composite return worksheet. And this isn't new, but any. The it 4708 is an annual tax return; Web include a check or money order with each it 4708 upc.

Web 2022 Ohio It 4708 Rev.

If an investor’s only source of ohio income is from. A pte filing it must aggregate the information contained in the multiple federal filings on a single it 4708 for the tax year. 1 withholding (default) from the. Go paperless and file electronically!