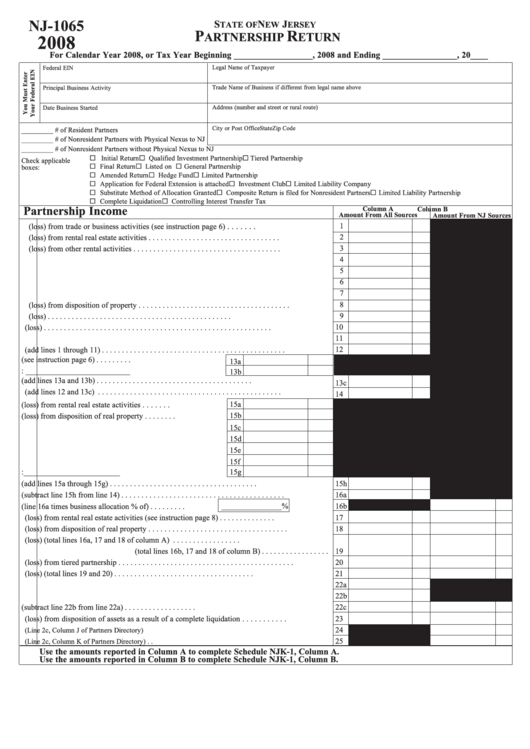

Nj Form 1065 Instructions

Nj Form 1065 Instructions - Easily fill out pdf blank, edit, and sign them. Returns for calendar year 2021 are due april 18, 2022. Use a nj 1065 instructions 2023 template to make your document workflow more streamlined. Of assets as a result of a line 18,. Choose the template you will need in the library of legal forms. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Gross income tax depreciation adjustment worksheet. If any of the identifying information is incorrect, please contact the division of. Partners subject to the gross income tax still must. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year.

Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Sign it in a few clicks. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year. Choose the template you will need in the library of legal forms. Form 1065 is used to report the income. Open form follow the instructions. A partnership must file even if its principal place of business is outside the.

Use a nj 1065 instructions 2023 template to make your document workflow more streamlined. 1174 nj tax forms and. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year. Returns for calendar year 2018 are due april 15, 2019. Gross income tax depreciation adjustment worksheet.

Edit your nj cbt 1065 online. A partnership must file even if its principal place of business is outside the. Partners subject to the gross income tax still must. Return of partnership income, including recent updates, related forms and instructions on how to file. Web here's how it works. Returns for calendar year 2021 are due april 18, 2022.

Business allocation schedule and instructions. Web use a nj 1065 instructions template to make your document workflow more streamlined. Easily fill out pdf blank, edit, and sign them. A partnership must file even if its principal place of business is outside the. Gross income tax depreciation adjustment worksheet.

Open form follow the instructions. Web the new jersey partnership and composite returns are prepared when new jersey is the home state or any entry is made on a new jersey worksheet. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year. Sign it in a few clicks.

1174 Nj Tax Forms And.

Web use a nj 1065 instructions template to make your document workflow more streamlined. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year. Gross income tax depreciation adjustment worksheet. A filing fee and tax may be imposed on the partnership.

Open Form Follow The Instructions.

If any of the identifying information is incorrect, please contact the division of. Web the new jersey partnership and composite returns are prepared when new jersey is the home state or any entry is made on a new jersey worksheet. Choose the template you will need in the library of legal forms. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web information about form 1065, u.s. A partnership must file even if its principal place of business is outside the. Returns for calendar year 2021 are due april 18, 2022. Edit your nj cbt 1065 online.

4/5 (217K Reviews)

1174 nj tax forms and templates are. Fiscal year returns are due the 15th day of the fourth month after the end of the tax year. 10 new jersey form 1065. Select the template you require in the library of legal forms.