New Jersey Inheritance Waiver Ta Form

New Jersey Inheritance Waiver Ta Form - The fill in cover sheet form is available at this link:. (bank accounts, stocks, bonds, and. For release of nj bank accounts, stock, brokerage accounts and investment bonds. This form is not a waiver and is not to be filed with the county. Web when there is any new jersey inheritance tax or estate tax due. If a trust agreement either exists or is created by the will, the division may require a full return should the terms of the trust indicate a possible inheritance tax. The tax waivers function as proof to the bank or other institution that death tax has been. Download your updated document, export it to the cloud, print it from the editor, or share it with others using a shareable link or as an email attachment. Web inheritance tax waivers are required only for real property located in new jersey. A waiver from the new jersey division of taxation releasing property where located from the inheritance taxes.

New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Brokerage accounts doing business in new jersey; Forward this form to the division of taxation at the address listed above. This form may be used only if all beneficiaries are class a, there is no new jersey inheritance or estate tax, and there is no requirement to file a tax return. Web inheritance tax waivers, however, are required only for n.j. • new jersey bank accounts; Real property held as tenancy by the entirety by a husband and wife or civil union partners as tenancy can be transferred without a tax waiver in.

Web when there is any new jersey inheritance tax or estate tax due. Brokerage accounts doing business in new jersey; Residents and domiciles for real property located in new jersey. Web this form may be used when: Web inheritance tax waivers, however, are required only for n.j.

Brokerage accounts doing business in new jersey; Residents and domiciles for real property located in new jersey. In such affidavit, the estate representative lists the beneficiaries and their relationship to the decedent so that the tax authorities can verify that only class a beneficiaries will receive distributions. Web updated on december 21, 2023. New jersey real property (such as real estate); (bank accounts, stocks, bonds, and.

Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. A cover sheet (or electronic synopsis). This form is specifically designed for reporting assets acquired through an estate and provides a detailed breakdown of the inherited property. Or • all beneficiaries are class e, or class e and class a. The fill in cover sheet form is available at this link:.

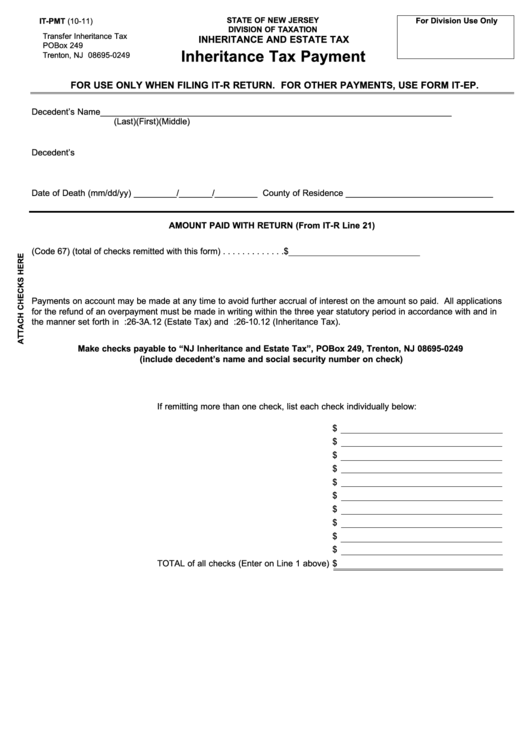

State of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. Web when there is any new jersey inheritance tax or estate tax due. Or • all beneficiaries are class e, or class e and class a. New jersey real property (such as real estate);

Web Using The Appraised Date Of Death Value And The Date Of Death Values Of Your Uncle’s Other Assets, You — Or More Likely, A Tax Preparer Such As An Accountant — Will Be Able To Prepare And File The.

Real property held as tenancy by the entirety by a husband and wife or civil union partners as tenancy can be transferred without a tax waiver in. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Web updated on december 21, 2023. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement.

Web This Form May Be Used When:

Download your updated document, export it to the cloud, print it from the editor, or share it with others using a shareable link or as an email attachment. Web inheritance tax waivers are required only for real property located in new jersey. Brokerage accounts doing business in new jersey; A waiver would not then be issued from this form.

Web Inheritance Tax Waivers, However, Are Required Only For N.j.

Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and approved by the bureau. Forward this form to the division of taxation at the address listed above. Web inheritance and estate tax forms. Web one way to obtain the tax waiver is to file a completed inheritance tax return.

• New Jersey Bank Accounts;

• a complete inheritance or estate tax return cannot be completed yet; The type of return or form required generally depends on: • stock in new jersey corporations; There is, however, an alternative designed to allow for the state to issue a waiver in cases when no tax is due and the alternative does not require that a full tax return be filed.