New Jersey Inheritance Waiver Ta Form 01

New Jersey Inheritance Waiver Ta Form 01 - Web this form may be used when: The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. O to get this form, you must file a return with the division. This form can only be issued by the division of taxation. Web here’s a quick summary of nj waiver requirements before the transfer of a decedent’s property. Web for all dates of death prior to january 1, 2018. Use get form or simply click on the template preview to open it in the editor. Each waiver will contain specific information about the property (such as: Web there is a $25,000 exemption for amounts inherited by class c beneficiaries. All beneficiaries are class e, or class e and class a.

Bank name, account balances, and names on the account). An estate tax return must be filed if an unmarried person dies and his or her estate exceeds. The new jersey transfer inheritance tax is a lien on all property owned by a decedent as of the date of his/her death for a period of 15 years. O to get this form, you must file a return with the division. • new jersey bank accounts; Web there is a $25,000 exemption for amounts inherited by class c beneficiaries. An inheritance tax return must be filed if money is inherited by anyone other than a spouse, child or charity.

Web the tax waivers function as proof to the bank or other institution that death tax has been paid to the state, and money can be released. A waiver from the new jersey division of taxation releasing property where located from the inheritance taxes. Web using the appraised date of death value and the date of death values of your uncle’s other assets, you — or more likely, a tax preparer such as an accountant — will be able to prepare and file the. Class d beneficiaries can receive $500 tax free. Transfer inheritance and estate tax.

An estate tax return must be filed if an unmarried person dies and his or her estate exceeds. Class d beneficiaries can receive $500 tax free. A cover sheet (or electronic synopsis). Bank name, account balances, and names on the account). (bank accounts, stocks, bonds, and brokerage accounts) Web using the appraised date of death value and the date of death values of your uncle’s other assets, you — or more likely, a tax preparer such as an accountant — will be able to prepare and file the.

And • new jersey investment bonds. Download your updated document, export it to the cloud, print it from the editor, or share it with others using a shareable link or as an email attachment. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. Web updated on december 21, 2023. Web a separate waiver will be issued for each asset.

Hnw april 6, 2024 estate administration and probate. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. O to get this form, you must file a return with the division. Web for all dates of death prior to january 1, 2018.

A Waiver From The New Jersey Division Of Taxation Releasing Property Where Located From The Inheritance Taxes.

The fill in cover sheet form is available at this link:. Web there is a $25,000 exemption for amounts inherited by class c beneficiaries. Web this form may be used when: • new jersey bank accounts;

Web A Separate Waiver Will Be Issued For Each Asset.

Use this form for release of: • stock in new jersey corporations; This form is specifically designed for reporting assets acquired through an estate and provides a detailed breakdown of the inherited property. Answered on 6/02/09, 8:08 am.

Web The Tax Waivers Function As Proof To The Bank Or Other Institution That Death Tax Has Been Paid To The State, And Money Can Be Released.

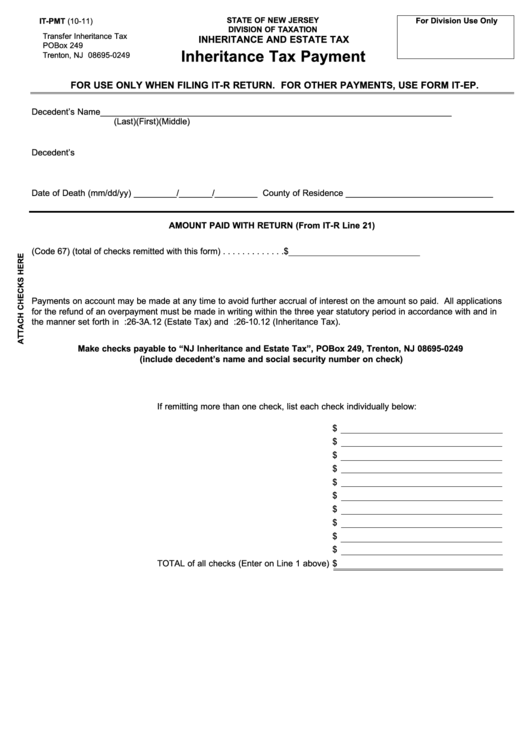

Web for all dates of death prior to january 1, 2018. Payment on account (estimated payment) voucher: Stock in new jersey corporations; A complete inheritance or estate tax return cannot be completed yet;

For Real Estate Investments, Use.

Application for extension of time to file a tax return inheritance tax/ estate tax: Web one way to obtain the tax waiver is to file a completed inheritance tax return. Web 1 answer from attorneys. Brokerage accounts doing business in new jersey;