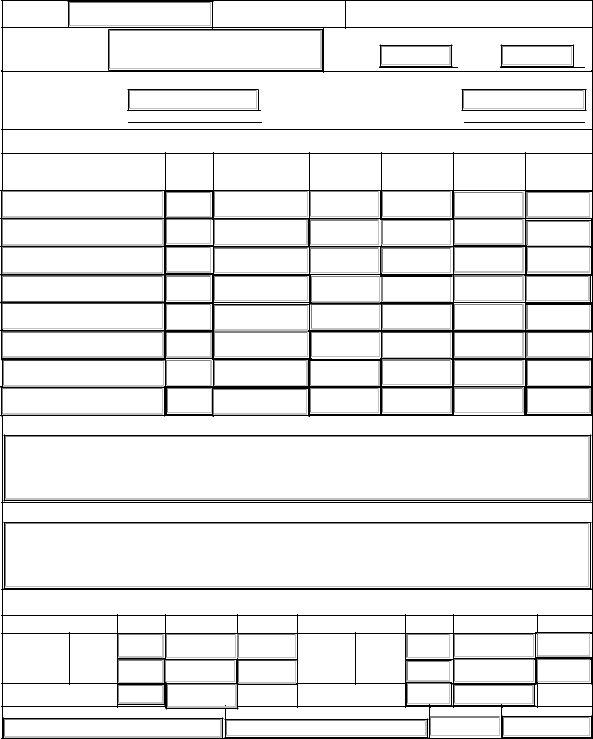

It 204 Ll Form

It 204 Ll Form - Our fee to prepare and file this form is $150. Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. Every llc that is a disregarded entity for. Web this form must be filed by every llc that is a disregarded entity for federal income tax purposes, and every llc, limited liability investment company (llic), limited liability. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources in. For calendar year 2022 or tax year beginning 22 and ending. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Note there are additional steps at the end of this procedure. Full remittance of any filing fee due should be. Submit your information by friday, march 1st, 2024 to file on time.

Web this form must be filed by every llc that is a disregarded entity for federal income tax purposes, and every llc, limited liability investment company (llic), limited liability. To print your 2022 tax return worksheets and schedules after you file, please follow these instructions: Web this form must be filed for limited liability companies (llcs) and limited liability partnerships (llps) that are treated as partnerships for federal income tax purposes and. 4.5/5 (111k reviews) Go to the ef center homebase. Learn how to electronically file, meet. For calendar year 2022 or tax year beginning 22 and ending.

Web the filing instructions also list the total of both the line 5 filing fee due plus the total penalty and interest. However, the other expected names like mohammed siraj,. Our fee to prepare and file this form is $150. An llc or llp that is. Submit your information by friday, march 1st, 2024 to file on time.

Web this form must be filed by every llc that is a disregarded entity for federal income tax purposes, and every llc, limited liability investment company (llic), limited liability. An llc or llp that is. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources in. Our fee to prepare and file this form is $150. Note there are additional steps at the end of this procedure. To print your 2022 tax return worksheets and schedules after you file, please follow these instructions:

An llc or llp that is. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources in. The filing deadline is friday, march 15th, 2024. Web this form must be filed by every llc that is a disregarded entity for federal income tax purposes, and every llc, limited liability investment company (llic), limited liability. 4.5/5 (111k reviews)

New york — partnership, limited liability company, and limited liability partnership filing fee payment form. You are expected to pay this amount with the return via electronic funds. Web this form must be filed for limited liability companies (llcs) and limited liability partnerships (llps) that are treated as partnerships for federal income tax purposes and. Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership.

Learn How To Electronically File, Meet.

You are expected to pay this amount with the return via electronic funds. To print your 2022 tax return worksheets and schedules after you file, please follow these instructions: Web this form must be filed by every llc that is a disregarded entity for federal income tax purposes, and every llc, limited liability investment company (llic), limited liability. It includes instructions, identification number, special condition code, and.

An Llc Or Llp That Is.

Web this form must be filed for limited liability companies (llcs) and limited liability partnerships (llps) that are treated as partnerships for federal income tax purposes and. Web this form is for partnerships, llcs, and llps to pay the new york state filing fee for tax year 2023. Go to the ef center homebase. Submit your information by friday, march 1st, 2024 to file on time.

New York — Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment Form.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Address (number and street or rural. However, the other expected names like mohammed siraj,. Every llc that is a disregarded entity for.

Our Fee To Prepare And File This Form Is $150.

Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. We last updated the partnership, limited liability. For calendar year 2022 or tax year beginning 22 and ending. Web the filing instructions also list the total of both the line 5 filing fee due plus the total penalty and interest.