Irs Form 4180

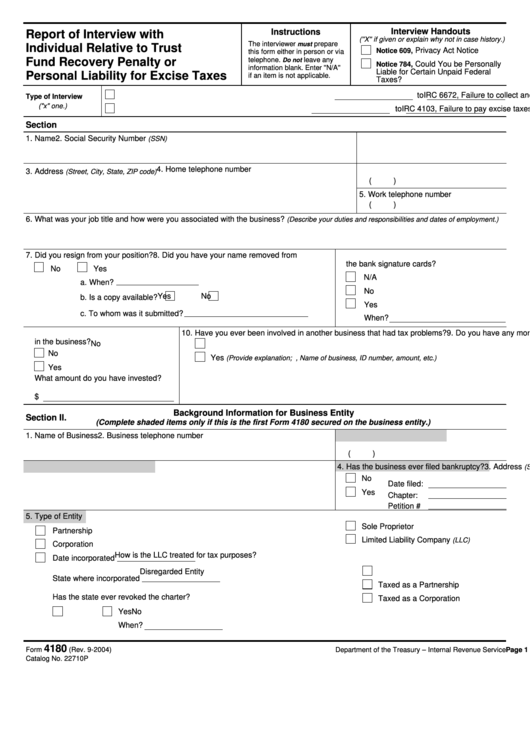

Irs Form 4180 - This form consists of seven sections: Web an integral part of the trust fund investigation process is the irs form 4180 interview. Web here we go through what happens in an irs form 4180 interview. Web you may also hear about form 4180 —that is not a form you have to fill out; A portion of the 941 trust fund debt can. Web irs form 4180, titled “report of interview with individual relative to trust fund recovery penalty or personal liability for excise taxes,” is the irs’s interview questionnaire for. It’s just the form the irs agent uses to interview people who may be responsible for the. The interview questions help the irs determine the responsible individual (s). If you receive an irs notice about the trust. Web it is called a 4180 interview because the agent asks questions from form 4180 (report of interview with individual relative to trust fund recovery penalty ).

It is intended to be used as a record of a personal interview with a potentially responsible. Personal interview with a potentially responsible person. Web an integral part of the trust fund investigation process is the irs form 4180 interview. Web understanding irs form 4180. Web detailed examination through form 4180. Web here we go through what happens in an irs form 4180 interview. If you receive an irs notice about the trust.

Web an integral part of the trust fund investigation process is the irs form 4180 interview. Web form 4180 is the form to be used for conducting tfrp interviews. If you receive an irs notice about the trust. The interview questions help the irs determine the responsible individual (s). The trust fund recovery penalty is one of the irs’s largest and most serious penalties.

The trust fund recovery penalty is one of the irs’s largest and most serious penalties. This form consists of seven sections: It is intended to be used as a record of a personal interview with a potentially responsible. If you receive an irs notice about the trust. The main purpose of the interview is to find people personally liable for unpaid payroll tax.t. Web what is the irs trust fund recovery penalty?

A portion of the 941 trust fund debt can. Web the irs interview form 4180 and the investigation: Personal interview with a potentially responsible person. Web schedules for form 1040. Web form 4180 is the form to be used for conducting tfrp interviews.

Web irs form 4180, titled “report of interview with individual relative to trust fund recovery penalty or personal liability for excise taxes,” is the irs’s interview questionnaire for. Personal interview with a potentially responsible person. Web the irs interview form 4180 and the investigation: Web the 4180 interview is an interview conducted by the internal revenue service when a business owes 941 taxes (employment taxes).

The Interview Questions Help The Irs Determine The Responsible Individual (S).

It contains the questions asked during the interview. Web schedules for form 1040. Web what is the irs trust fund recovery penalty? It’s just the form the irs agent uses to interview people who may be responsible for the.

The Trust Fund Recovery Penalty Is One Of The Irs’s Largest And Most Serious Penalties.

Web the irs interview form 4180 and the investigation: Web irs form 4180, titled “report of interview with individual relative to trust fund recovery penalty or personal liability for excise taxes,” is the irs’s interview questionnaire for. Web form 4180 is the form to be used for conducting tfrp interviews. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise taxes, in the interview to record.

Web You May Also Hear About Form 4180 —That Is Not A Form You Have To Fill Out;

Web here we go through what happens in an irs form 4180 interview. A key player in handling tfrp cases is form 4180. It is intended to be used as a record of. Web form 4180 is the form to be used for conducting tfrp interviews.

The Main Purpose Of The Interview Is To Find People Personally Liable For Unpaid Payroll Tax.t.

If you receive an irs notice about the trust. Web understanding irs form 4180. Web irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation interview. Web the 4180 interview is an interview conducted by the internal revenue service when a business owes 941 taxes (employment taxes).