Franklin County Local Ta Form

Franklin County Local Ta Form - Occupational tax ordinance occupational tax forms Web tax sale lien tax sale lien view news quick links quick links view now contact information. The franklin county area tax bureau (fcatb) follows the decisions of the pennsylvania department of revenue (pa dor) regarding. 2022 form 531 and instructions. Tips and information we recommend you read before getting started. Web to use the forms provided by the city of columbus income tax division, we recommend you download the forms and open them using the newest version of acrobat reader. Berkheimer tax administrator offers online filing for the quarterly estimated earned income tax return and the local earned income tax return. Web 2023 earned income tax filing deadline. Web fiscal > fiscally speaking > form center. You may download franklin county tax forms here.

In order to view and print these forms, you must have the adobe pdf reader installed on your computer. All local earned income tax documents may be mailed directly to our office at: Berkheimer tax administrator offers online filing for the quarterly estimated earned income tax return and the local earned income tax return. The 2024 tax filing deadline is monday, april 15, 2024. Real estate excise tax form. You can locate excise tax and supplemental forms on the department of revenue website. Web final individual tax form 531 local earned income and net profits tax return (2023 and prior years) 2023 form 531 and instructions.

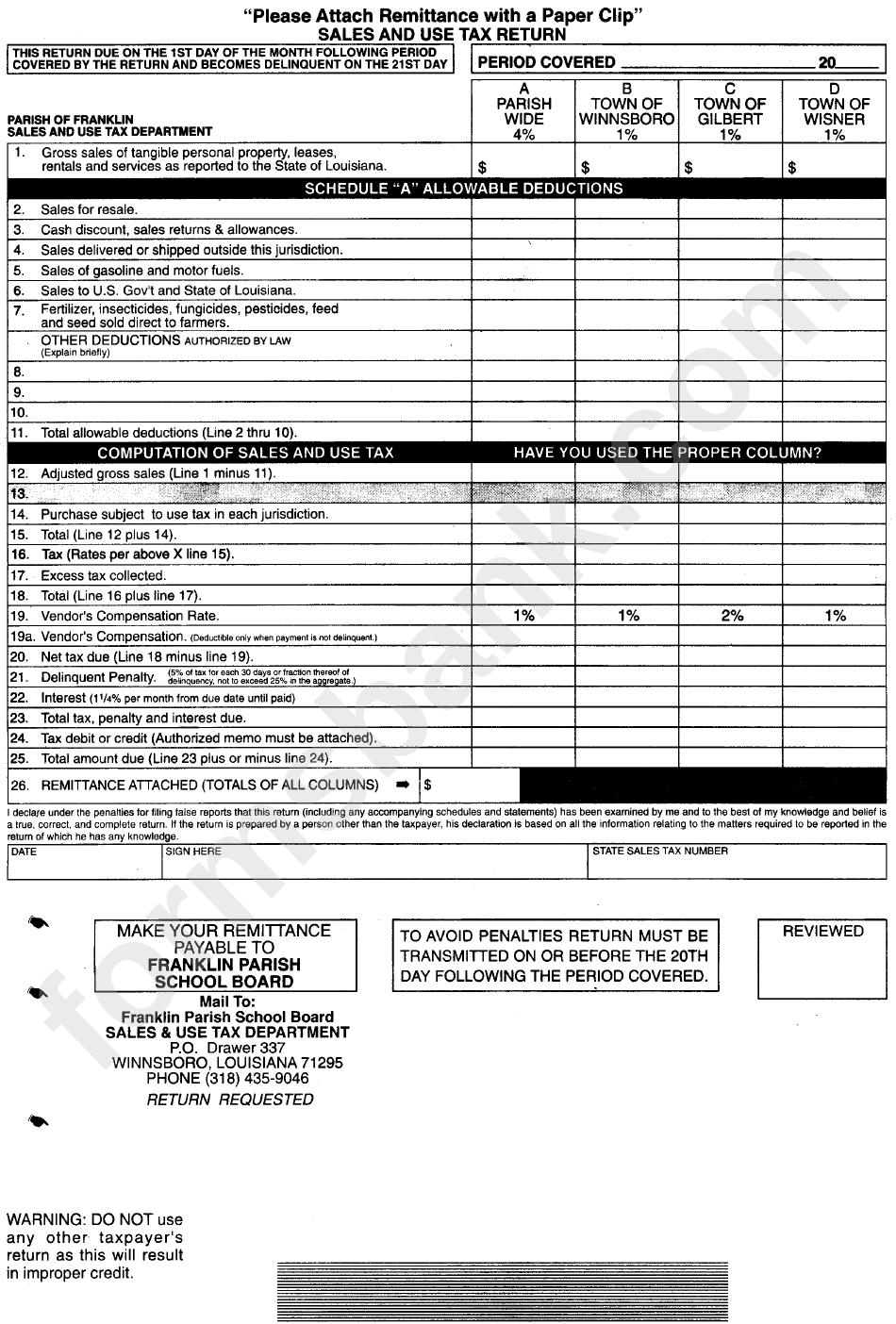

Welcome to ohio's tax finder. You may download franklin county tax forms here. Real estate excise tax form. Web tax sale lien tax sale lien view news quick links quick links view now contact information. Web employer withholding tax return (form 511) earned income tax (eit) and local services tax (lst)

Web fiscal > fiscally speaking > form center. Web the county occupational tax rate will remain at the current rate of 1% for 2018, for both payroll and net profits. The 2024 tax filing deadline is monday, april 15, 2024. Web to use the forms provided by the city of columbus income tax division, we recommend you download the forms and open them using the newest version of acrobat reader. An excise tax form must. Municipal & school eit office.

All local earned income tax documents may be mailed directly to our office at: Web employer withholding tax return (form 511) earned income tax (eit) and local services tax (lst) Stratt byars, revenue commissioner email: You can locate excise tax and supplemental forms on the department of revenue website. An excise tax form must.

Occupational tax ordinance occupational tax forms Web the county occupational tax rate will remain at the current rate of 1% for 2018, for both payroll and net profits. Web final individual tax form 531 local earned income and net profits tax return (2023 and prior years) 2023 form 531 and instructions. In order to view and print these forms, you must have the adobe pdf reader installed on your computer.

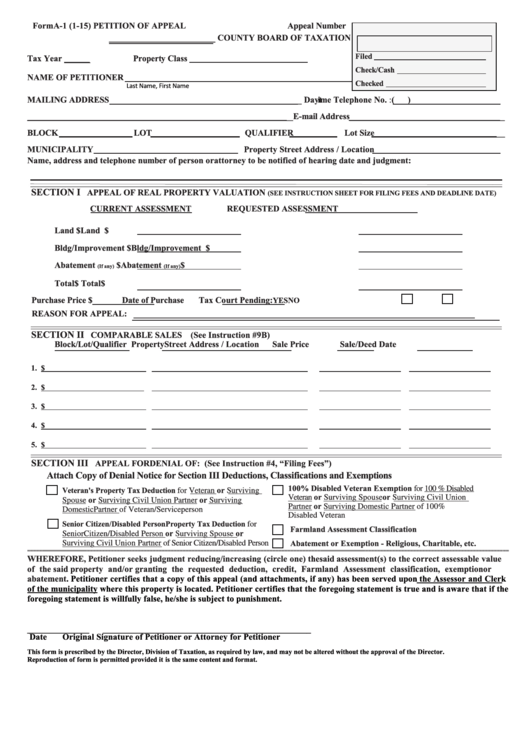

Occupational Tax Ordinance Occupational Tax Forms

Web final individual tax form 531 local earned income and net profits tax return (2023 and prior years) 2023 form 531 and instructions. The 2024 tax filing deadline is monday, april 15, 2024. Web 2023 earned income tax filing deadline. You can locate excise tax and supplemental forms on the department of revenue website.

Berkheimer Tax Administrator Offers Online Filing For The Quarterly Estimated Earned Income Tax Return And The Local Earned Income Tax Return.

The franklin county area tax bureau (fcatb) follows the decisions of the pennsylvania department of revenue (pa dor) regarding. Tips and information we recommend you read before getting started. Web tax sale lien tax sale lien view news quick links quick links view now contact information. 2022 form 531 and instructions.

You May Download Franklin County Tax Forms Here.

An excise tax form must. Welcome to ohio's tax finder. Municipal & school eit office. Search or select the form you need from the lists below.

Web If You Are Looking For Specific Instructions Or Information On Which Of These Forms To Use, Please Click On Either The Individual Or Business Button Located On The Left Navigation.

Real estate excise tax form. Earned income taxes and local services taxes are collected on the borough’s behalf by the franklin county area tax bureau. In order to view and print these forms, you must have the adobe pdf reader installed on your computer. Web fiscal > fiscally speaking > form center.