Form 8804 Schedule A

Form 8804 Schedule A - How do i override a partner's 8805? Web purpose of form. Web form 8804 is filed separately from the form 1065, u.s. The partnership must also file a form 8805 for each partner on whose behalf it paid sec. Web check if schedule a (form 8804) is attached. Web 2023 schedule a (form 8804) the partnership is using the annualized income installment method. Web what is irs form 8804 schedule a? The program will generate a critical diagnostic reminding you that form 8804 is filed separately from the return. How do i override a. Web form 8804, known as the annual return for partnership withholding tax, is akin to an umbrella form that provides a summary of the various forms 8805 issued to.

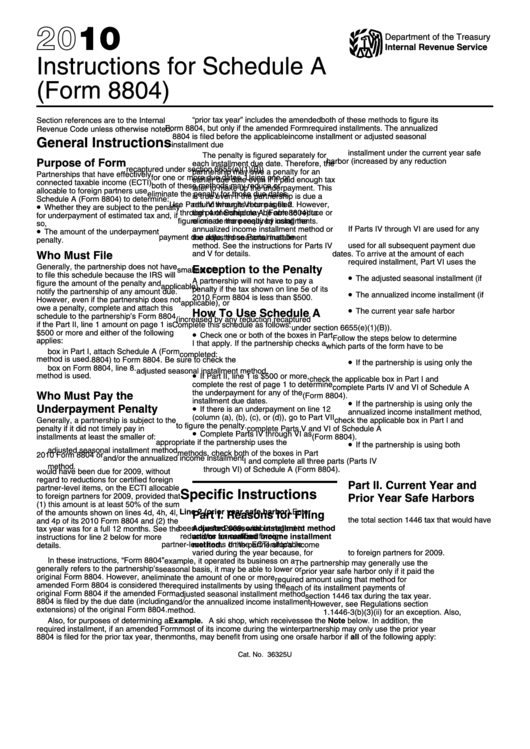

Web to produce schedule a (form 8804), penalty for underpayment of estimated section 1446 tax for partnerships, use worksheet withholding tax payment, section options and. How do i override a partner's 8805? Web 2023 schedule a (form 8804) the partnership is using the annualized income installment method. Check the box for annual return for partnership withholding tax (8804). Current year and prior year safe harbors. Web what is irs form 8804 schedule a? How do i override a.

Web check if schedule a (form 8804) is attached. The partnership must also file a form 8805 for each partner on whose behalf it paid sec. Current year and prior year safe harbors. Web form 8804 is filed separately from the form 1065, u.s. Enter the total section 1446 tax shown on the partnership’s 2022 form 8804, line 5f.

Check the box for annual return for partnership withholding tax (8804). Web scroll down to the filing instructions section. The program will generate a critical diagnostic reminding you that form 8804 is filed separately from the return. Work from desktop or mobile. Use the sign tool to create your special signature for the record legalization. Web form 8804 is filed separately from the form 1065, u.s.

Form 8804 form 8804, annual return for. Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount. The partnership must also file a form 8805 for each partner on whose behalf it paid sec. How do i override a partner's 8805? Web in other words, form 8804 must be filed even if the partnership has an overall loss.

Use the sign tool to create your special signature for the record legalization. Web what is irs form 8804 schedule a? Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti). Work from desktop or mobile.

Web 2022 Schedule A (Form 8804) Part Ii.

2023 instructions for schedule a (form. Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount. It is due by the 15th day of the third month following the end of the partnership's. Web form 8804 is filed separately from the form 1065, u.s.

The Program Will Generate A Critical Diagnostic Reminding You That Form 8804 Is Filed Separately From The Return.

Web scroll down to the filing instructions section. Partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form 8804) to determine: Web to produce schedule a (form 8804), penalty for underpayment of estimated section 1446 tax for partnerships, use worksheet withholding tax payment, section options and. How do i override a.

Enter The Total Section 1446 Tax Shown On The Partnership’s 2022 Form 8804, Line 5F.

See instructions add lines 5f and 8 ~~~~~ ~~~~~ | ~~~~~ if line 7 is smaller than line 9, subtract line 7 from line 9. Check the box for annual return for partnership withholding tax (8804). Complete editing by clicking on done. Form 8804 form 8804, annual return for.

How Do I Override A Partner's 8805?

Web three forms are required for reporting and paying over tax withheld on effectively connected income allocable to foreign partners. Current year and prior year safe harbors. The partnership must also file a form 8805 for each partner on whose behalf it paid sec. Web check if schedule a (form 8804) is attached.