Financial Model E Ample E Cel

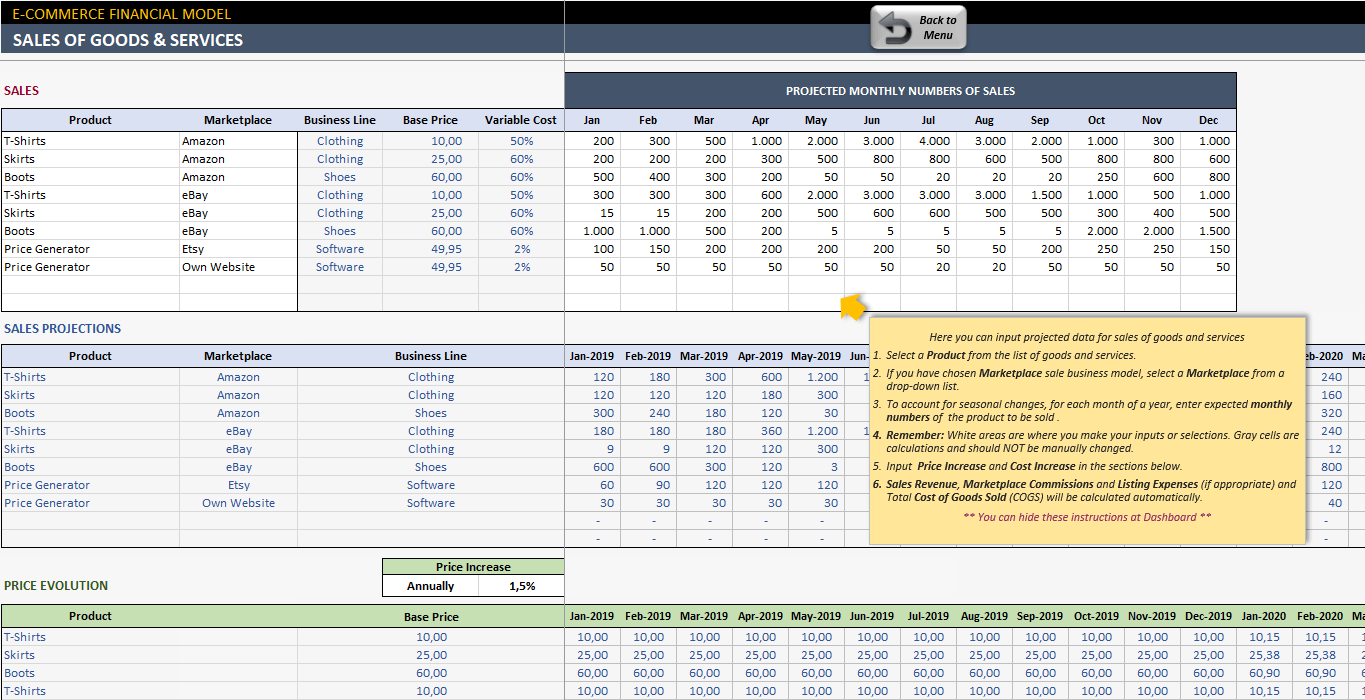

Financial Model E Ample E Cel - Web financial modeling is the process of creating a mathematical representation of a company’s historical performance. It allows finance professionals to forecast future financial outcomes, evaluate investment opportunities, and. Web excel is an indispensable tool for financial modeling, and mastering its formulas can take your skills to the next level. Web financial model templates, financial planning and management tools in excel to be used by businesses in a variety of industries and business sectors. Hello and welcome to a new series from the excel community's financial modelling committee, in which we will work through the chapters of our financial modelling code and explain how each element translates into practice. There are various advanced excel techniques that can be used for financial modeling. Whether you're a beginner or an experienced modeler, understanding and applying the right formulas can save you time, reduce errors, and provide valuable insights into your financial data. Web we’ve got you covered! Web financial modeling is the process of estimating a project or business’s financial performance by considering all relevant factors, growth and risk assumptions clearly understand the impact. Web how to apply cell styles in excel.

Web financial modeling is the process of creating a mathematical representation of a company’s historical performance. It provides a simple way to calculate important metrics such as roi, irr, and net present value. Web by using financial modeling, an organization can analyze internal and external financial data, identify possible opportunities and risks, and forecast the future impacts of such decisions. It enables the user to clearly understand all the variables involved in financial forecasting. Hello and welcome to a new series from the excel community's financial modelling committee, in which we will work through the chapters of our financial modelling code and explain how each element translates into practice. Hello and welcome to a new series from the excel community's financial modelling committee, in which we will work through the chapters of our financial modelling code and explain how each element translates into practice. Use of cell background colors.

Our sophisticated finance models can be used for fundraising, valuation, investment analysis, and many more applications. It provides a simple way to calculate important metrics such as roi, irr, and net present value. Using cell styles will make formatting your work much, much faster. There are various advanced excel techniques that can be used for financial modeling. If you have a big assignment and many hours of work to go, this can be the difference between going home early or going home tomorrow.

Whether you're a beginner or an experienced modeler, understanding and applying the right formulas can save you time, reduce errors, and provide valuable insights into your financial data. Our sophisticated finance models can be used for fundraising, valuation, investment analysis, and many more applications. Web financial modeling in excel refers to tools used for preparing the expected financial statements predicting the company’s financial performance in a future period using the assumptions and historical performance information. However, i do think there are some best practices when it comes to financial modeling in excel. Web how to apply cell styles in excel. Using cell styles will make formatting your work much, much faster.

Check out our large inventory of state of the art financial modeling spreadsheet templates in excel and google sheets It provides a simple way to calculate important metrics such as roi, irr, and net present value. Without a universally accepted set of agreed principles, it can be difficult to know what good looks like in financial modelling terms. Web in summary, excel is a powerful tool for financial modeling and analyzing investments. Web explore and download the financial model templates in excel listed below to help you in your financial modeling tasks.

It enables the user to clearly understand all the variables involved in financial forecasting. If you have a big assignment and many hours of work to go, this can be the difference between going home early or going home tomorrow. Web here is a list of financial modelling examples and their ideal contexts to help you learn more: Also, making changes to the whole file can be done in seconds.

Web Excel Is An Indispensable Tool For Financial Modeling, And Mastering Its Formulas Can Take Your Skills To The Next Level.

Web financial modeling is the process of creating a summary of a company's expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision. Since there isn’t a specific “right” and “wrong” way to build a financial model, a lot of it comes down to preference; Also, making changes to the whole file can be done in seconds. Web choose among the many excel financial model templates to help you prepare budgets, financial plans, business plans, and cash flow projections for businesses.

Make Financial Models Easy To Use.

Web financial modeling is the process of creating a mathematical representation of a company’s historical performance. These financial model excel templates are not specific to one industry which means, you can reuse them for your next financial model regardless of. Web explore and download the financial model templates in excel listed below to help you in your financial modeling tasks. Web we’ve got you covered!

Hello And Welcome To A New Series From The Excel Community's Financial Modelling Committee, In Which We Will Work Through The Chapters Of Our Financial Modelling Code And Explain How Each Element Translates Into Practice.

You can read the code here or watch our free webinar about it. Web financial modeling is the process of estimating a project or business’s financial performance by considering all relevant factors, growth and risk assumptions clearly understand the impact. Use of cell background colors. The development and use of financial models in excel continues to proliferate, as does the variety of approaches and methodologies adopted.

Whether You're A Beginner Or An Experienced Modeler, Understanding And Applying The Right Formulas Can Save You Time, Reduce Errors, And Provide Valuable Insights Into Your Financial Data.

It provides a simple way to calculate important metrics such as roi, irr, and net present value. Hello and welcome to a new series from the excel community's financial modelling committee, in which we will work through the chapters of our financial modelling code and explain how each element translates into practice. However, i do think there are some best practices when it comes to financial modeling in excel. Web learn to format excel professionally.