Fillable Form 1120S

Fillable Form 1120S - Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Income tax return for an (irs) fill online, printable, fillable, blank form 1120s: Use fill to complete blank online irs pdf forms for free. Shareholder’s share of income, deductions, credits, etc. Components of a form 1120s. Whether you decide to use a tax professional, use tax software, or complete this form by hand, you’ll need your corporation’s financial information and documentation to complete form 1120. Form 1120 is the tax form c corporations (and llcs filing as corporations) use to file their income taxes. Go to www.irs.gov/form1120 for instructions and the latest information. Or 2) any income derived from missouri sources. Department of the treasury internal revenue service.

Once you’ve completed form 1120, you should have an idea of how much your corporation needs to pay in taxes. However, the number of attached documents may vary depending on the requirements of the irs. Components of a form 1120s. They are required for the irs report. Once completed you can sign your fillable form or send for signing. Sign it in a few clicks. Construction work excluding vat and the cost of materials.

Or 2) any income derived from missouri sources. Once completed you can sign your fillable form or send for signing. 1) a shareholder that is a missouri resident; Go to www.irs.gov/form1120s for instructions and the latest information. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation.

Before you jump in to the form, you’ll need to have the following items handy: Sign it in a few clicks. Edit your free fillable 1120s form online. Department of the treasury internal revenue service for calendar year 2023, or tax year. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Once completed you can sign your fillable form or send for signing.

Sign it in a few clicks. All forms are printable and downloadable. Send 2023 form 1120s fillable via email, link, or fax. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Department of the treasury internal revenue service.

They are required for the irs report. Share your form with others. The form must be accompanied by b, k, and l forms. Adobe reader or any alternative for windows or macos are required to access and complete fillable content.

Department Use Only (Mm/Dd/Yy) Missouri Tax I.d.

Information you’ll need to file form 1120s. Or 2) any income derived from missouri sources. All forms are printable and downloadable. Edit your free fillable 1120s form online.

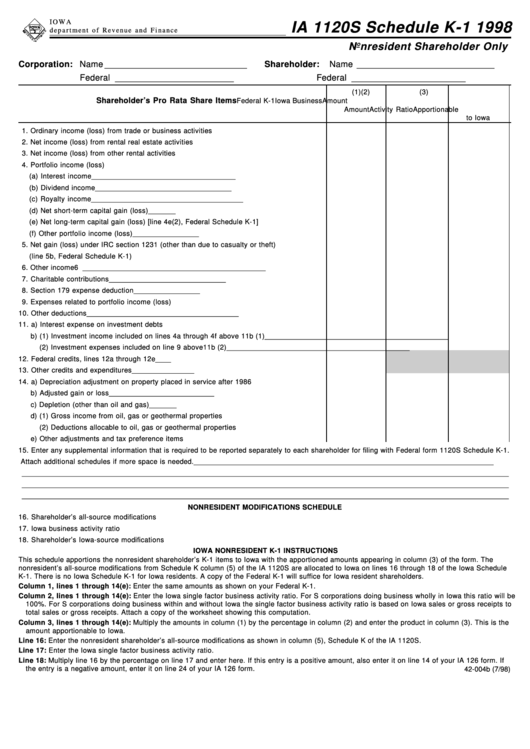

Shareholder’s Share Of Income, Deductions, Credits, Etc.

For calendar year 2023 or tax year beginning , 2023, ending , 20. Web what is form 1120? Type text, add images, blackout confidential details, add comments, highlights and more. Go to www.irs.gov/form1120 for instructions and the latest information.

Income Tax Return For An (Irs) Form.

Before you jump in to the form, you’ll need to have the following items handy: Web information about form 1120, u.s. Form 1120 is the tax form c corporations (and llcs filing as corporations) use to file their income taxes. Whether you decide to use a tax professional, use tax software, or complete this form by hand, you’ll need your corporation’s financial information and documentation to complete form 1120.

Income Tax Return For An S Corporation Do Not File This Form Unless The Corporation Has Filed Or Is Attaching Form 2553 To Elect To Be An S Corporation.

This test is based on ‘net turnover’. Corporation income tax return, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service for calendar year 2023, or tax year. A list of your products or services;