Convertible Debt Note Template

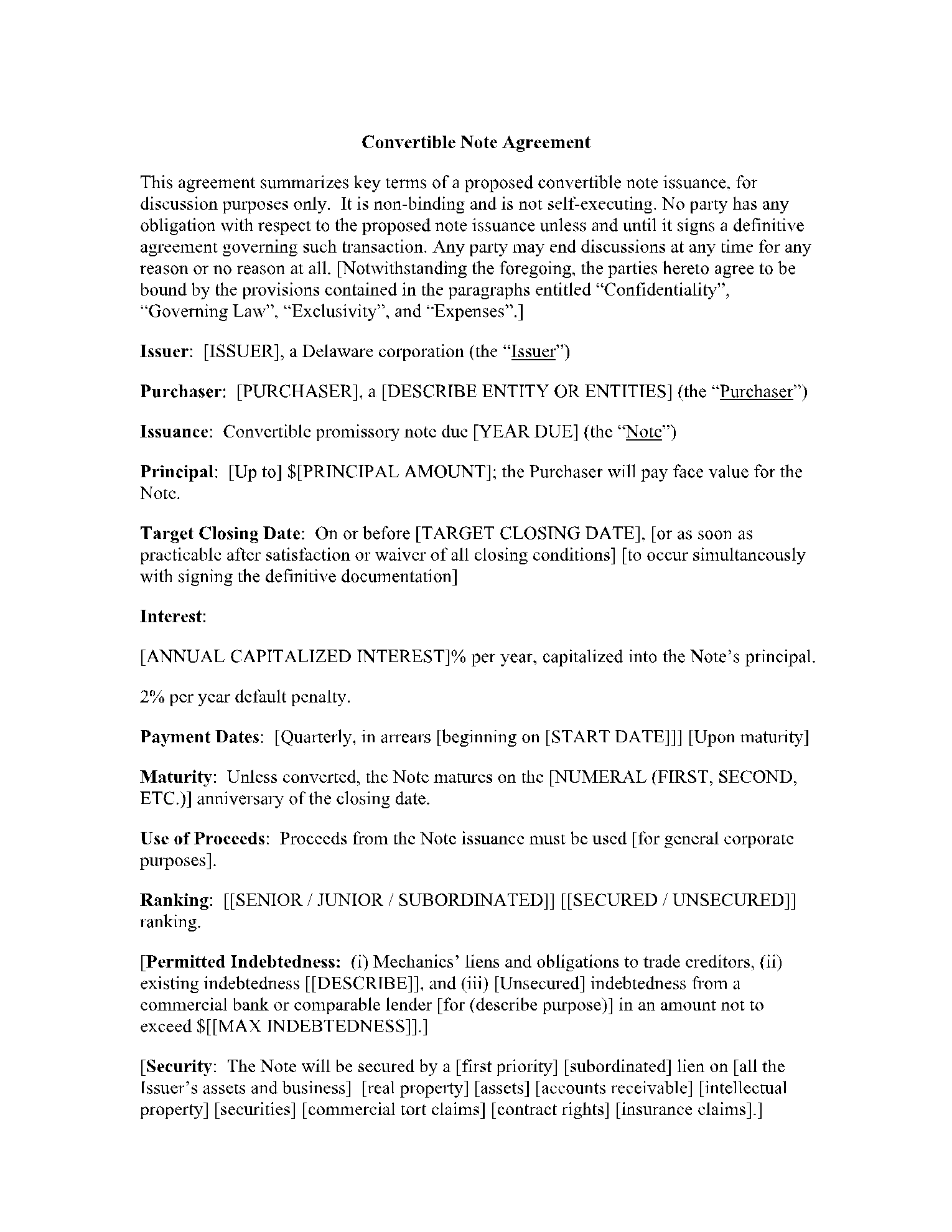

Convertible Debt Note Template - It can be downloaded here. The investor gives you money, and in return, you agree to pay back the ‘principal’ amount at a set time. It includes a discounted fully diluted price per share. Web convertible note template | eqvista. If you’d like to discuss this template or notes generally, try. Convertible debt is a way for companies to raise capital in their early stages of development. It is essentially a loan from an investor to your company. Generally, convertible debt facilitates capital investments. There are a few convertible note templates available for founders who are interested in raising this type of financing. Web convertible note agreement template.

Web convertible note templates. Web a convertible note, or convertible loan, is a type of investment that initially begins life as debt, but has the ability to convert into equity once new funding is raised. You also give the investor interest, usually called ‘coupon’ payments. We’ve created a publicly downloadable template for a seed convertible note (with useful footnotes), based on the template we’ve used hundreds of times in seed convertible note deals across the u.s. Generally, a note is a debt instrument. This is called the maturity date. Fill & sign this document online.

Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes ( a debt instrument that converts into equity under predetermined circumstances ). Startups can negotiate and raise seed funding and angel funding easily with this legal convertible note template. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. It serves as a template for the convertible note for both parties. Most companies have investors who offer money that serves as the capital for the business to operate.

Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes ( a debt instrument that converts into equity under predetermined circumstances ). Web template documents for convertibles — the holloway guide to raising venture capital. It serves as a template for the convertible note for both parties. You also give the investor interest, usually called ‘coupon’ payments. Convertible notes may be more preferable among investors since they are less risky, have a clearer structure with predefined terms, accruing interest and a maturity date. Financing ≫ choosing a financing structure ≫.

Using convertible notes is one of the ways that startups acquire seed funding. How does a convertible loan agreement work? Web convertible note template | eqvista. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. It includes a discounted fully diluted price per share.

Fill & sign this document online. Financing ≫ choosing a financing structure ≫. Generally, convertible debt facilitates capital investments. This is called the maturity date.

Web A Convertible Note, Or Convertible Loan, Is A Type Of Investment That Initially Begins Life As Debt, But Has The Ability To Convert Into Equity Once New Funding Is Raised.

Web in contrast to safe notes, convertible ones start as a debt. Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes ( a debt instrument that converts into equity under predetermined circumstances ). Web a convertible note is a type of debt instrument issued by a company to investors. Companies need capital to operate.

There Are A Few Convertible Note Templates Available For Founders Who Are Interested In Raising This Type Of Financing.

Startups can negotiate and raise seed funding and angel funding easily with this legal convertible note template. Web convertible debt (or a “convertible note”) is often used as a method for making an equity financing investment. Why use a convertible note? How does a convertible loan agreement work?

Most Companies Have Investors Who Offer Money That Serves As The Capital For The Business To Operate.

You also give the investor interest, usually called ‘coupon’ payments. Web convertible note agreement template. We’ve created a publicly downloadable template for a seed convertible note (with useful footnotes), based on the template we’ve used hundreds of times in seed convertible note deals across the u.s. Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their early stages.

Using Convertible Notes Is One Of The Ways That Startups Acquire Seed Funding.

Go to the generate documents tab, choose international from the dropdown and select convertible loan note. It includes a discounted fully diluted price per share. Generally, a note is a debt instrument. It is essentially a loan from an investor to your company.