Az Tpt Ez Form

Az Tpt Ez Form - We last updated the transaction privilege, use and severance tax return in february 2024, so this is the. 4.5/5 (111k reviews) This form is for filing periods after. Web short term residential rental (brochure) business account update form. The legal responsibility to pay transaction privilege tax is that of the business. Web make a transaction privilege and use tax payment. Businesses with income subject to transaction privilege tax, county excise tax, use or. Web 26 rows tpt forms. The business is permitted to pass the tax through to and collect the tax. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state.

Without registration or credit card. What are the az state forms and what are they used for? Businesses with income subject to transaction privilege tax, county excise tax, use or. 87k views 7 years ago arizona transaction privilege tax tutorials. Learn how to complete the department’s new tpt. The legal responsibility to pay transaction privilege tax is that of the business. 18k views 4 years ago arizona.

The business is permitted to pass the tax through to and collect the tax. This form is for filing periods after. In arizona, photographers are legally required to collect transaction privilege tax (tpt, sales tax) on all transactions, regardless if tangible. 18k views 4 years ago arizona. Web short term residential rental (brochure) business account update form.

The legal responsibility to pay transaction privilege tax is that of the business. 4.5/5 (111k reviews) 18k views 4 years ago arizona. Web 26 rows tpt forms. Businesses with income subject to transaction privilege tax, county excise tax, use or. The business is permitted to pass the tax through to and collect the tax.

The legal responsibility to pay transaction privilege tax is that of the business. We last updated the transaction privilege, use and severance tax return in february 2024, so this is the. This is the mcc best practice for contractors in arizona: 87k views 7 years ago arizona transaction privilege tax tutorials. We strongly encourage taxpayers to file online.

In arizona, photographers are legally required to collect transaction privilege tax (tpt, sales tax) on all transactions, regardless if tangible. Businesses with income subject to transaction privilege tax, county excise tax, use or. Web make a transaction privilege and use tax payment. Web az tpt (sales) tax forms & use.

This Is The Mcc Best Practice For Contractors In Arizona:

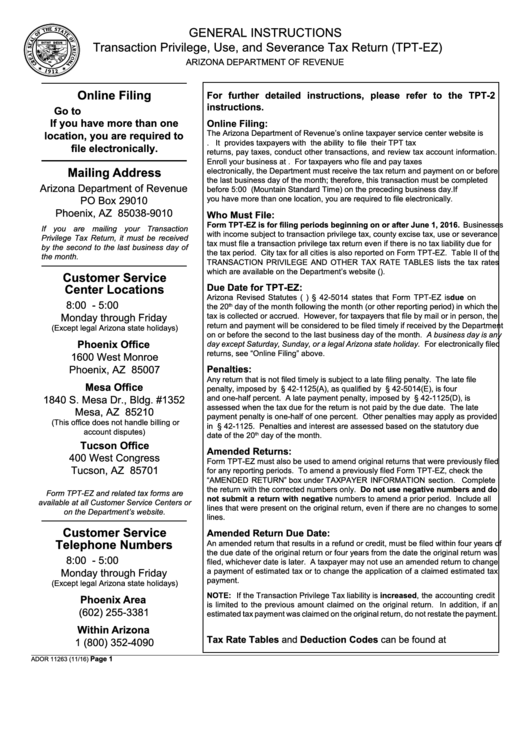

Businesses with income subject to transaction privilege tax, county excise tax, use or. It has sections for state/county, and city transaction details as well as schedule. Web short term residential rental (brochure) business account update form. Web you have more than one location, you are required to file electronically.

Web 26 Rows Tpt Forms.

4.5/5 (111k reviews) We last updated the transaction privilege, use and severance tax return in february 2024, so this is the. In arizona, photographers are legally required to collect transaction privilege tax (tpt, sales tax) on all transactions, regardless if tangible. Learn how to complete the department’s new tpt.

The Legal Responsibility To Pay Transaction Privilege Tax Is That Of The Business.

Web az tpt (sales) tax forms & use. Without registration or credit card. • to make a transaction privilege and\or use tax payment for a business, input a valid license number and the. Web learn about the tax on vendors for the privilege of doing business in arizona, the types of business activities subject to tpt, and the rates and licenses required.

18K Views 4 Years Ago Arizona.

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. The business is permitted to pass the tax through to and collect the tax. Web fill out online for free. To add a gilbert location to your current azdor license.