Arizona Form 140Es

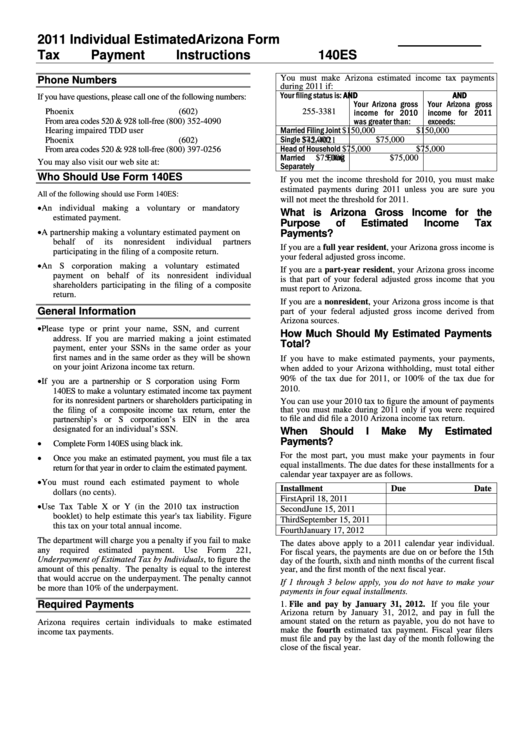

Arizona Form 140Es - • an individual mailing a voluntary or mandatory estimated payment, • a partnership mailing a voluntary estimated payment on behalf of its nonresident individual partners participating in the filing of a composite return, and Web you may use form 140ez if all of the following apply: For use with arizona form 140es. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment; 2 check only one box for the quarter for which this payment is made. Shown as income on your federal worksheet. Web arizona form for calendar year. For information or help, call one of the numbers listed: Step 1 estimated arizona taxable income. Web we last updated the individual estimated tax payment booklet in march 2024, so this is the latest version of form 140es, fully updated for tax year 2023.

Shown as income on your federal worksheet. The latest edition provided by the arizona department of revenue; They are available in turbotax (see the state forms availability page here ). Small business payment type options include: Web arizona estimated tax and extension information. 1 released form 140es, 2021 individual estimated income tax payment, with instructions. Use the arizona estimates/underpayments worksheet > estimate preparation section to force, prevent, or alter the calculation of form 140es.

Web we last updated the individual estimated tax payment booklet in march 2024, so this is the latest version of form 140es bklt, fully updated for tax year 2023. The latest edition provided by the arizona department of revenue; This estimated payment is for tax year ending december 31, 2023, or for tax year ending: Arizona form for calendar year. For use with arizona form 140es.

Shown as income on your federal worksheet. Web worksheet for computing estimated payments for individuals. Web file now with turbotax. Web we last updated the individual estimated tax payment booklet in march 2024, so this is the latest version of form 140es, fully updated for tax year 2023. This estimated payment is for tax year ending december 31, 2023, or for tax year ending: Web arizona estimated tax and extension information.

Web you may use form 140ez if all of the following apply: 2017 individual estimated income tax payment. Arizona form for calendar year. Web worksheet for computing estimated payments for individuals. • an individual mailing a voluntary or mandatory estimated payment, • a partnership mailing a voluntary estimated payment on behalf of its nonresident individual partners participating in the filing of a composite return, and

You can print other arizona tax forms here. 2 check only one box for the quarter for which this payment is made. For more information about the arizona income tax, see the arizona income tax page. Step 1 estimated arizona taxable income.

The Latest Edition Provided By The Arizona Department Of Revenue;

Web individual payment type options include: 1 released form 140es, 2021 individual estimated income tax payment, with instructions. For information or help, call one of the numbers listed: Web march 19, 2022 7:10 am.

This Estimated Payment Is For Tax Year Ending December 31, 2023, Or For Tax Year Ending:

We last updated arizona form 140es in march 2024 from the arizona department of revenue. For use with arizona form 140es. Web printable arizona income tax form 140es. Web arizona estimated tax and extension information.

• An Individual Mailing A Voluntary Or Mandatory Estimated Payment, • A Partnership Mailing A Voluntary Estimated Payment On Behalf Of Its Nonresident Individual Partners Participating In The Filing Of A Composite Return, And

Use the arizona estimates/underpayments worksheet > estimate preparation section to force, prevent, or alter the calculation of form 140es. A partnership or s corporation mailing a voluntary estimated payment on behalf of its nonresident individual partners/shareholders participating in the filing of a composite return. Step 1 estimated arizona taxable income. Individuals who do not pay income taxes through automatic withholding may be required to pay their arizona income tax quarterly using form 140es (income tax estimate).

Do Not Select More Than One Quarter.

They are available in turbotax (see the state forms availability page here ). Web we last updated the individual estimated tax payment booklet in march 2024, so this is the latest version of form 140es bklt, fully updated for tax year 2023. Do not select more than one quarter. Step 1 estimated arizona taxable income.