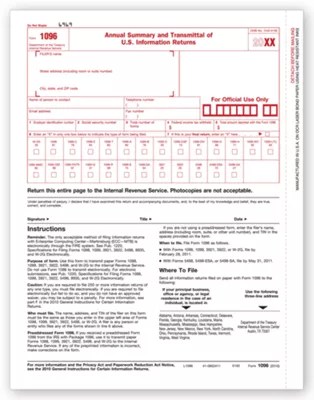

1096 Form 2024

1096 Form 2024 - Print 1096 forms for qbo. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Send all information returns filed on paper to the following. Are you looking for another form or document? Information about form 1096, annual summary and transmittal of u.s. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. 2 what information is reported on form 1096? Web the irs requires all paper tax forms to be accompanied by irs form 1096, annual summary and transmittal of u.s. How to fill out form 1096. Do you operate or own a small business that employs independent contractors throughout the year?

Instructions for form 1096 pdf. For the latest information about developments related to form 1096, such as legislation enacted after it was published, go to www.irs.gov/form1096. How to fill out form 1096. Corrected for privacy act and paperwork reduction act notice, see the. Where to file form 1096. 1 what is irs form 1096 and what is it used for? To make corrections in a 1096 form.

Last updated january 19, 2024 9:53 am. Web one such form is the 1096 form, also known as the annual summary and transmittal of u.s. Paper filing may also be an option if direct file says you can fix your rejected return by filing a paper return. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. To make corrections in a 1096 form.

Web if you submitted your federal tax return through direct file and it was rejected, you had until april 20, 2024 to correct and resubmit it electronically via direct file. This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it. For the latest information about developments related to form 1096, such as legislation enacted after it was published, go to www.irs.gov/form1096. Enter the total federal income tax withheld shown on the forms being transmitted with this form 1096. Web when is form 1096 due? Web one such form is the 1096 form, also known as the annual summary and transmittal of u.s.

Page last reviewed or updated: Instructions for form 1096 pdf. Do you also use paper filing to file your tax forms? What is irs form 1096? Small business resource center small business tax prep.

Information returns, is — as its official name implies — a summary document. Where to mail form 1096. Proper preparation and adherence to filing requirements and deadlines are crucial for businesses to maintain compliance with irs regulations. Web historic caseload data comes from statistical reports.

Web One Such Form Is The 1096 Form, Also Known As The Annual Summary And Transmittal Of U.s.

Print 1096 forms for qbo. Form 1096 is used to summarize and transmit various tax forms to the irs, serving as a cover sheet for these information returns. Web written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • february 6, 2024 4:18 pm. This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it.

For Internal Revenue Service Center.

How to fill out form 1096. Web historic caseload data comes from statistical reports. Updated on february 23, 2022. Web the deadline to file form 1096 is february 28 each year.

This Is An Early Release Draft Of An Irs Tax Form, Instructions, Or Publication, Which The Irs Is Providing For Your Information.

Send all information returns filed on paper to the following. Web the irs requires all paper tax forms to be accompanied by irs form 1096, annual summary and transmittal of u.s. Otherwise, the deadline is february 28, 2024 if you file on paper, and march 31, 2024 if you file electronically. Where to mail form 1096.

To Print The 1096 Form.

Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Do not include blank or voided forms or the form 1096 in your total. Information returns,” is a summary document used when filing certain irs information returns by mail. Do not file draft forms and do not rely on draft forms, instructions, and pubs for filing.